VIEW HMRC R&D TAX STATISTICS FOR 2024

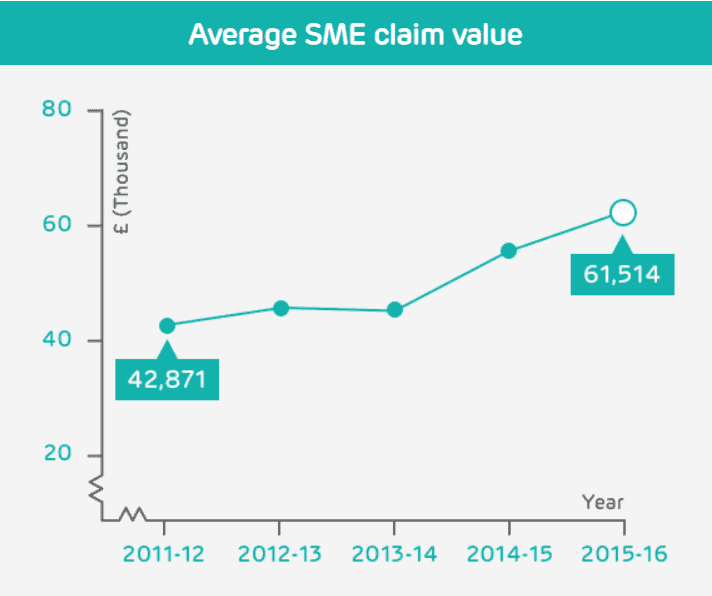

Published last week, HMRC’s research and development (R&D) tax credits statistics are good news for innovative businesses and good news for the UK economy. All of the statistics are moving in the right direction, with both total claims and the amount of relief up by 20%. The average claim value has increased for SMEs and for large companies, to £61,514 and £348,916 respectively.

There were no huge surprises, and the ‘manufacturing’, ‘information & communication’ and ‘professional, scientific & technical’ sectors continue to have the greatest volume of claims. R&D tax credit claims are concentrated in companies with a registered office in London and the South East, in terms of volume and value.

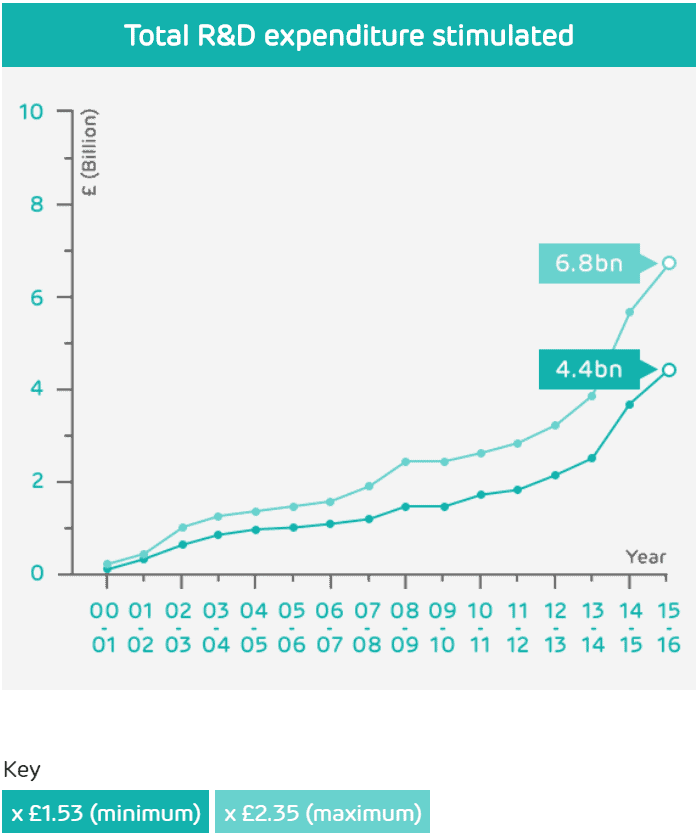

R&D tax credits contribute £6.8bn to the economy

A total of £2.9bn was claimed in R&D tax credits by innovative UK companies during 2015-16. Based on research carried out by HMRC, this £2.9bn of relief may have stimulated up to £6.8bn of additional R&D investment.

To put this figure in perspective, £6.8bn is the same as the cost of building Wembley Stadium more than six times over – which, back in 2007, cost £798 million (£1.07 billion today).

In a working paper, Evaluation of Research and Development Tax Credit, HMRC assessed the impact of R&D tax credits on R&D investment in the UK. Their evaluation estimates that every pound spent on R&D tax credits stimulates between £1.53 and £2.35 in R&D spend by UK companies. The chart below shows the cost of support claimed from 2000-01 to 2015-16 and the potential range of the additional expenditure stimulated based on this analysis.

This is good news for the UK economy.

Value for money

Total tax receipts for 2015-16 were £534bn. This means the £2.8bn spent by the government on R&D tax credits is equivalent to just 0.5% of all money collected by HMRC. In our opinion, this represents good value for money, especially considering how much R&D tax credits are worth in terms of additional R&D expenditure stimulated: £6.8bn.

R&D tax credits are not just good news for the economy; they are also good news for the businesses that use them. Our own research tells us that innovative companies use the money they receive to hire new staff, help with cash flow, and gain competitive advantage by investing in further R&D. For Dartington Crystal, for example, their R&D tax credit allows them to begin new engineering projects more quickly with more resource, ultimately improving customer outcomes.

SME R&D tax credit claims by sector

It’s all the more important that all eligible companies claim. So, which SMEs claimed R&D tax credits via the SME R&D scheme in 2015-16?

Very few companies claiming R&D tax credits are in this sector. On average, those that are claiming, are only receiving 74% of the average claim value for SMEs (£61,514). You can find out more about this sector in our blog about Agritech.

What counts as R&D in this sector?

- Developing sensors to track soil quality and improve crop yields.

- Developing vertical farming techniques to reduce land footprint and water usage.

- Building a robotic device to harvest vegetables.

Total claims

Agriculture, Forestry, Fishing R&D Claims: 110

All SME claims: 21,685

Value of claims

Agriculture, Forestry, Fishing R&D Claims: £5m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Agriculture, Forestry, Fishing R&D Claims: £45,455

Note, we have assumed the amount claimed as the value for this sector is suppressed in HMRC’s data. Just 15 Mining & Quarrying companies claimed R&D tax credits. Despite the low uptake in this sector, the average claim value is 270% larger than the average SME claim value – but considering the R&D costs associated with mining and quarrying activities, this is to be expected.

What counts as R&D in this sector?

- Developing a new mining process which has less environmental impact.

- Replicating a piece of machinery, but creating it at a lower cost.

Total claims

Mining & Quarrying R&D Claims: 15

All SME claims: 21,685

Value of claims

Mining & Quarrying R&D Claims: £2m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Mining & Quarrying R&D Claims: £166,000

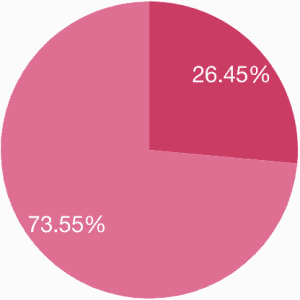

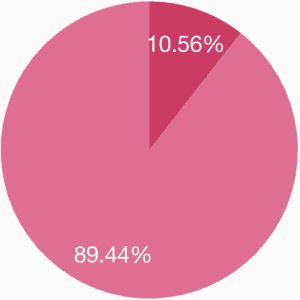

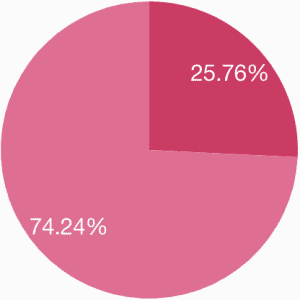

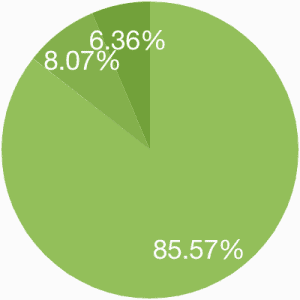

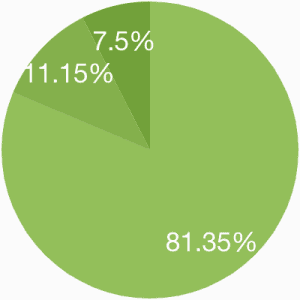

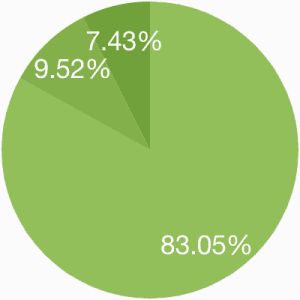

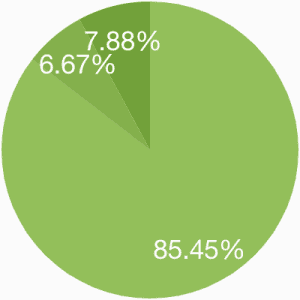

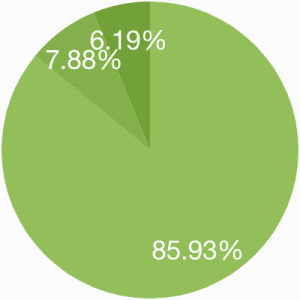

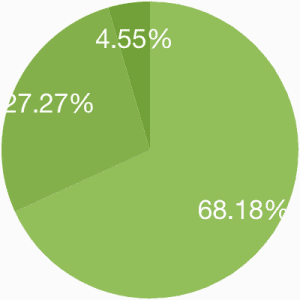

The manufacturing sector is traditionally R&D intensive. Therefore it is no surprise that 26% of all SME claims are made by firms in this industry. Manufacturing companies received 23% of the total amount claimed by SMEs. The average claim value they received was below the scheme average (£48,823 compared to £61,514).

What counts as R&D in this sector?

- Creating a new lighter-weight material to improve efficiency.

- Using a new method to create an existing product with less waste.

- Developing a new coating for fabric to withstand high temperatures.

Total claims

Manufacturing R&D Claims: 5,735

All SME claims: 21,685

Value of claims

Manufacturing R&D Claims: £280m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Manufacturing R&D Claims: £48,823

Only a small number of companies claiming R&D tax credits are in this sector. However, those that are claiming are receiving a significant benefit. The average claim value is three times larger than the average SME claim value, comparable only to the Mining & Quarrying sector.

What counts as R&D in this sector?

- Designing and building new biomass boilers.

- Developing a new compact fuel cell.

Total claims

Electricity, Gas, Steam & Air Conditioning R&D Claims: 30

All SME claims: 21,685

Value of claims

Electricity, Gas, Steam & Air Conditioning R&D Claims: £5m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Electricity, Gas, Steam & Air Conditioning R&D Claims: £166,667

This sector is comparable to Agriculture, Forestry & Fishing. 110 companies claimed £5 million, meaning on average they only received 74% of the average SME claim value.

What counts as R&D in this sector?

- Creating a portable water filtration system that can be used by hikers.

- Developing a new waste management system with fewer emissions.

- Solving onsite technical problems during the chemical waste process.

Total claims

Water, Sewerage & Waste R&D Claims: 110

All SME claims: 21,685

Value of claims

Water, Sewerage & Waste R&D Claims: £5m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Water, Sewerage & Waste R&D Claims: £45,455

2% of innovative SMEs claiming R&D tax credits are in the construction industry. The average claim value in this industry is particularly low at 60% of the average SME claim value.

What counts as R&D in this sector?

- Developing a new anti-vibration product to reduce stress on buildings.

- Creating a bespoke retractable roof for a stadium.

- Designing different architectural structures to optimise acoustics.

Total claims

Construction R&D Claims: 540

All SME claims: 21,685

Value of claims

Construction R&D Claims: £20m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Construction R&D Claims: £37,037

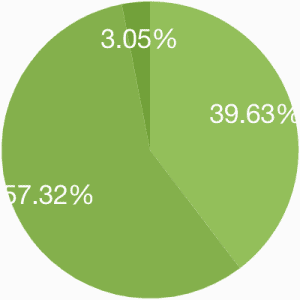

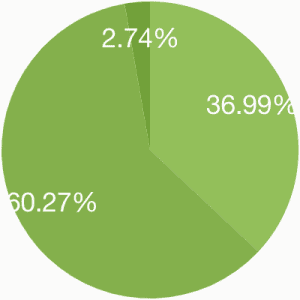

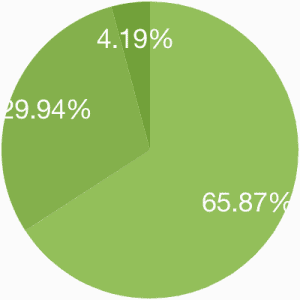

This sector ranks fourth in terms of the total claims made by SMEs – 11% of SMEs claiming are in the Wholesale, Retail Trade & Repairs sector. The average claim value for these firms is broadly similar to the construction industry, and is low compared to the benefit received on average by all SMEs (£61,514).

What counts as R&D in this sector?

- Building a bespoke e-commerce platform that allows for personalised experiences.

- Designing new trucks that have capacity for more pallets per truck.

- Producing new blockchain technology to effectively manage shipments and reduce costs.

Total claims

Wholesale & Retail Trade, Repairs R&D Claims: 2,290

All SME claims: 21,685

Value of claims

Wholesale & Retail Trade, Repairs R&D Claims: £80m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Wholesale & Retail Trade, Repairs R&D Claims: £34,934

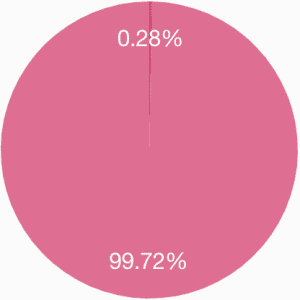

Transport & Storage companies account for less than 1% of SMEs claiming R&D tax credits, and they benefit from a total of £10m worth of funding. We’ve written at length about the transport industry on our blog.

What counts as R&D in this sector?

- Developing new fully-compostable packing materials.

- Creating low waste coolants to use in refrigerated trucks.

- Developing new lane assist technology for self-driving cars.

- Using big data to create software to scan for competitive flight prices.

Total claims

Transport & Storage R&D Claims: 145

All SME claims: 21,685

Value of claims

Transport & Storage R&D Claims: £10m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Transport & Storage R&D Claims: £68,966

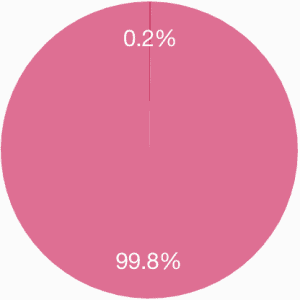

Note, we have assumed the amount claimed as the value for this sector is suppressed in HMRC’s data. Very few companies claiming R&D tax credits are in this sector. Those that are claiming, are on average only receiving two thirds of the average claim value for SMEs (£61,514). We discuss whether innovation in this sector is R&D or a marketing gimmick in our blog about the food and beverage industry.

What counts as R&D in this sector?

- Making an existing product taste the same but with lower sugar and salt content.

- Replicating a well-known food where the recipe is a trade secret.

- Creating a new manufacturing process to handle free-from products.

Total claims

Accommodation & Food R&D Claims: 60

All SME claims: 21,685

Value of claims

Accommodation & Food R&D Claims: £2m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Accommodation & Food R&D Claims: £41,500

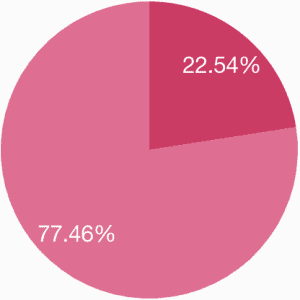

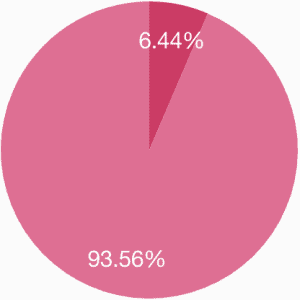

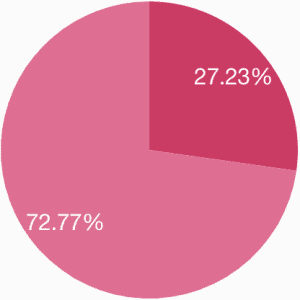

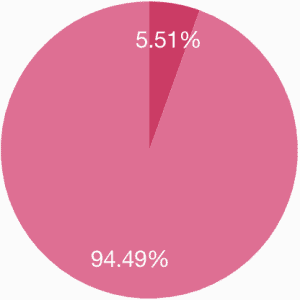

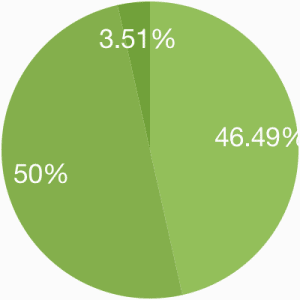

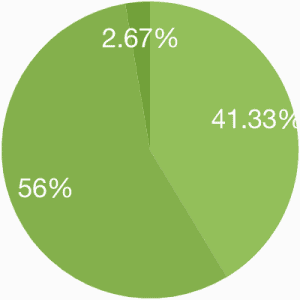

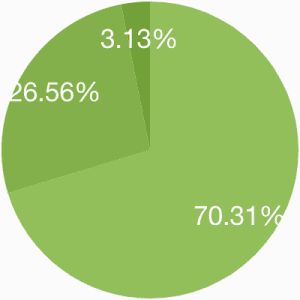

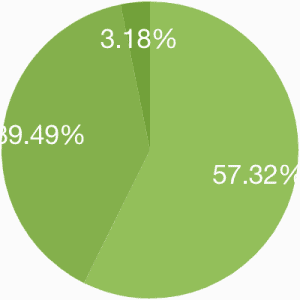

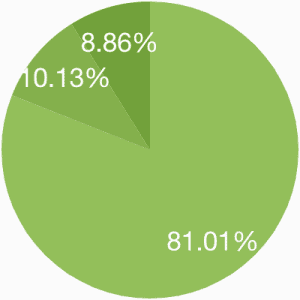

27% of all SME claims were made by Information & Communication companies – the top ranking sector this year for both volume and value. This isn’t surprising given that you would find a significant amount of tech firms in this sector. The average claim value for Information & Communication is just above the average SME claim value.

What counts as R&D in this sector?

- Using AI and machine learning to develop chatbots.

- Modifying LED technology to create wireless networks.

- Improving backwards and forwards compatibility with wireless networks.

Total claims

Information & Communication R&D Claims: 5,905

All SME claims: 21,685

Value of claims

Information & Communication R&D Claims: £385m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Information & Communication R&D Claims: £65,199

Only a small number of companies claiming R&D tax credits are in this sector. Those companies that do claim are receiving on average slightly more than other SMEs. You can find out more about financial R&D and insurance R&D on our blog.

What counts as R&D in this sector?

- Developing apps and sensors to test driver safety for insurance premiums.

- Creating a system that can predict future spending patterns.

- Creating a payment platform that integrates with social media to send cash to friends.

Total claims

Financial & Insurance R&D Claims: 285

All SME claims: 21,685

Value of claims

Financial & Insurance R&D Claims: £20m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Financial & Insurance R&D Claims: £70,175

Note, we have assumed the amount claimed as the value for this sector is suppressed in HMRC’s data. This sector is very similar to Accommodation & Food in terms of claim volumes and value. Very few companies in this sector claim R&D tax credits and those that do are on average only receiving two thirds of the average claim value for SMEs (£61,514).

What counts as R&D in this sector?

- Using VR to allow tours of homes before they’re built.

- Creating new slimmer insulation materials for housing.

- Developing modular homes for use in disaster zones.

Total claims

Real Estate R&D Claims: 60

All SME claims: 21,685

Value of claims

Real Estate R&D Claims: £2m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Real Estate R&D Claims: £41,500

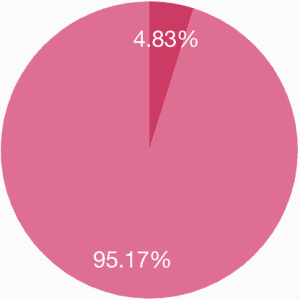

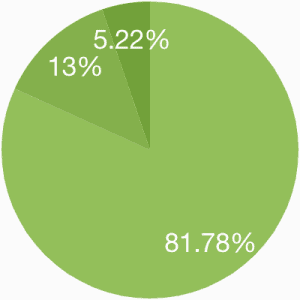

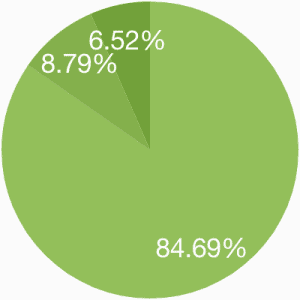

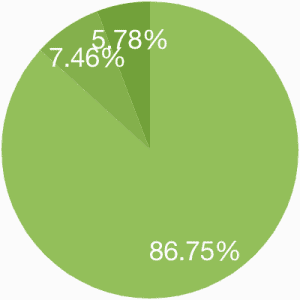

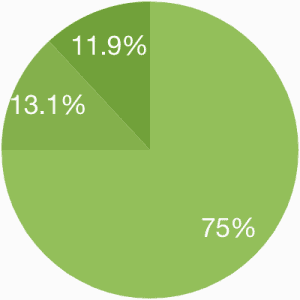

Another traditional sector for R&D, Professional, Scientific & Technical ranks third in terms of the number of claims made. Firms in this sector receive 26% of all tax relief claimed via the SME R&D Scheme.

What counts as R&D in this sector?

- Integrating bespoke platforms with legacy systems.

- Developing gene slicing techniques.

- Creating remotely operated vehicles to cope with deep ocean dives.

Total claims

Professional, Scientific & Technical R&D Claims: 4,210

All SME claims: 21,685

Value of claims

Professional, Scientific & Technical R&D Claims: £320m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Professional, Scientific & Technical R&D Claims: £76,010

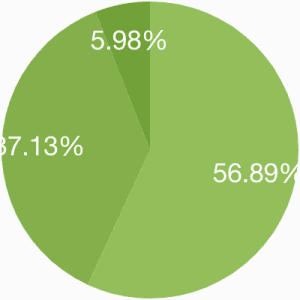

6% of all claims made by SMEs are in this sector. This category covers a broad range of companies and the average claim value for Admin & Support Services is lower than average for the SME scheme as a whole.

What counts as R&D in this sector?

- Producing keyless door locks that open with an NFC app.

- Using machine learning to optimise dictation technology.

- Developing new collaborative working software.

Total claims

Admin & Support Services R&D Claims: 1,195

All SME claims: 21,685

Value of claims

Admin & Support Services R&D Claims: £60m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Admin & Support Services R&D Claims: £50,209

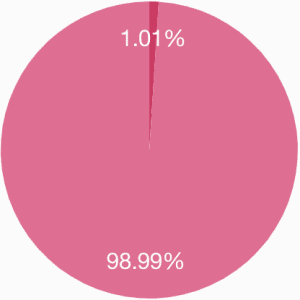

Only 1% of SME claims are made by Education companies. This sector has the lowest average claim value at just 37% of what other SMEs are receiving on average (£61,514). You can find out more about EdTech in our blog about the future of education.

What counts as R&D in this sector?

- Developing a bespoke platform to integrate video into home learning.

- Creating online software that allows for collaborative projects.

- Using AI to create an adaptive learning platform.

Total claims

Education Claims: 220

All SME claims: 21,685

Value of claims

Education Claims: £5m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Education Claims: £22,727

Humanities and the social sciences are specifically excluded as R&D by the guidelines. So it isn’t a surprise that only 1% of SME claims are made by firms in this sector. These companies share tax relief worth £10 million.

What counts as R&D in this sector?

- Creating stronger, lighter-weight prosthetics.

- Developing wearables to track and report on symptoms.

- Developing new cleaning techniques with lasers.

Total claims

Health & Social Work R&D Claims: 180

All SME claims: 21,685

Value of claims

Health & Social Work R&D Claims: £10m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Health & Social Work R&D Claims: £55,556

Just 1% of SME claims are in this sector. However, the amount received by these firms is 10% more than the average received by SMEs in general.

What counts as R&D in this sector?

- Engineering bespoke design festival stages.

- Developing a smart suitcase with GPS tracking.

- Using AI to track and compare the cheapest flights.

Total claims

Arts, Entertainment and Recreation R&D Claims: 220

All SME claims: 21,685

Value of claims

Arts, Entertainment and Recreation R&D Claims: £15m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Arts, Entertainment and Recreation R&D Claims: £68,182

Total claims

Other Services Activities R&D Claims: 375

All SME claims: 21,685

Value of claims

Other Services Activities R&D Claims: £15m

Value of all SME claims: £1.2bn

Average claim

Average claim value for Other Services Activities R&D Claims: £440,000

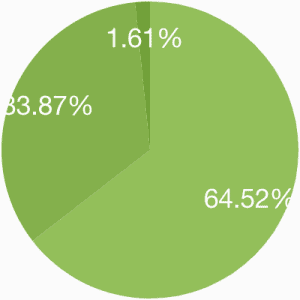

Regional allocation is based on the postcode of the company’s registered address, which might not correspond to where R&D takes place.

Benchmark your R&D tax credit claim by region

And where are those businesses based?

The South West, where we’re lucky to be based, is a tech hub with sectors from aerospace and advanced engineering, to creative agencies and food production.

Total claims

SMEs: 1,750

Large companies: 165

SMEs in large companies & REDC: 130

Value of claims

SMEs: £80m

Large companies: £42m

SMEs in large companies & RDEC: £2m

Average claim

SMEs: £45,714

Large companies: £257,515

SMEs in large companies & RDEC: £19,154

With the largest UK regional economy outside of London, the South East is particularly involved in pharmaceuticals, ICT and the space tech sector.

Total claims

SMEs: 3,685

Large companies: 505

SMEs in large companies & RDEC: 340

Value of claims

SMEs: £265m

Large companies: £285m

SMEs in large companies & RDEC: £20m

Average claim

SMEs: £71,913

Large companies: £564,356

SMEs in large companies & RDEC: £58,824

The capital city boasts a broad range of sectors with business, financial and professional services being prevalent, as well as a strong creative media industry.

Total claims

SMEs: 3,995

Large companies: 635

SMEs in large companies & RDEC: 255

Value of claims

SMEs: £325m

Large companies: 470m

SMEs in large companies & RDEC: £25m

Average claim

SMEs: £81,352

Large companies: £740,157

SMEs in large companies & RDEC: £98,039

With a strong agricultural history, East England, continues to be a leading food producer. But now, it also boasts Silicon Fen, Cambridge’s hi-tech hub for biochemistry and electronics.

Total claims

SMEs: 2,180

Large companies: 250

SMEs in large companies & RDEC: 195

Value of claims

SMEs: £155m

Large companies: £210m

SMEs in large companies & RDEC:: £10m

Average claim

SMEs: £71,101

Large companies: £840,000

SMEs in large companies & RDEC: £51,282

As well as being the birthplace of Cadbury’s chocolate, the Midlands are home to Motorsport Valley, a booming computer games industry, manufacturing and retail.

Total claims

SMEs: 3,180

Large companies: 330

SMEs in large companies & RDEC: 245

Value of claims

SMEs: £135m

Large companies: £220m

SMEs in large companies & RDEC: £10m

Average claim

SMEs: £42,453

Large companies: £666,606

SMEs in large companies & RDEC: £40,816

Following a decline in the hard industries, service industries, especially finance, and tech businesses have risen in the urban centres with agriculture remaining strong in rural areas.

Total claims

SMEs: 705

Large companies: 55

SMEs in large companies & RDEC: 65

Value of claims

SMEs: £45m

Large companies: £17m

SMEs in large companies & RDEC: £2m

Average claim

SMEs: £63,830

Large companies: £318,000

SMEs in large companies & RDEC: £38,308

Powered by the industrial revolution, the North East is a hotbed of engineering expertise, with recent growth in the life sciences sectors. Healthcare and sustainable energy are also strong across Yorkshire and Humber.

Total claims

SMEs: 2,325

Large companies: 200

SMEs in large companies & RDEC: 155

Value of claims

SMEs: £110m

Large companies: £50m

SMEs in large companies & RDEC: £7m

Average claim

SMEs: £47,312

Large companies: £249,900

SMEs in large companies & RDEC: £48,323

With a history of engineering, the North West continues to be a leader in advanced manufacturing. There is a large media cluster in Manchester and hi-tech businesses in Liverpool.

Total claims

SMEs: 2,290

Large companies: 210

SMEs in large companies & RDEC: 165

Value of claims

SMEs: £90m

Large companies: £62m

SMEs in large companies & RDEC: £5m

Average claim

SMEs: £39,301

Large companies: £297,571

SMEs in large companies & RDEC: £30,303

Scotland, with its strong presence of oil and gas industries, has a long history in the financial services industry and also a strong presence with renewable energy, life sciences and electronics.

Total claims

SMEs: 945

Large companies: 145

SMEs in large companies & RDEC: 150

Value of claims

SMEs: £95m

Large companies: £62m

SMEs in large companies & RDEC: £10m

Average claim

SMEs: £100,529

Large companies: £378,727

66,667

Birthplace of the ill-fated Titanic, Northern Ireland is home to heavy manufacturing and a thriving agri-food sector.

Total claims

SMEs: 640

Large companies: 80

SMEs in large companies & RDEC: 70

Value of claims

SMEs: £30m

Large companies: £12m

SMEs in large companies & RDEC: £2m

Average claim

SMEs: £46,875

Large companies: £156,125

SMEs in large companies & RDEC: £35,571

Trend one:

The average SME claim value is increasing

The average amount of relief claimed via the SME scheme is £61,514, compared to £56,223 last year. This continues the positive trend of the last five years and supports the idea that once a company claims R&D tax credits, it continues to make further investment in R&D.

In addition, as companies become more familiar with the requirements for making an R&D claim, it is likely that they will start to implement record keeping processes to enable them to capture expenditure more accurately, leading to more robust, and often larger, R&D tax credit claims.

Trend two:

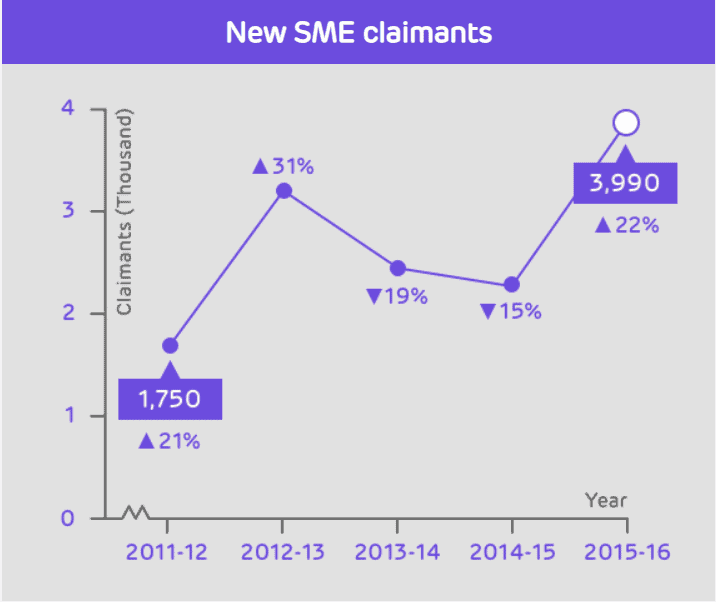

More SMEs are accessing the incentive

The number of SME claims increased to 21,865, up 22% on last year. This bucks the recent trend which saw the rate of growth decrease year on year – more claims overall but fewer new claimants each year.

This positive news suggests awareness of R&D tax credits is increasing amongst SMEs. However, there is still work to be done as it is universally recognised that the SME R&D scheme is under-utilised.

Trend three:

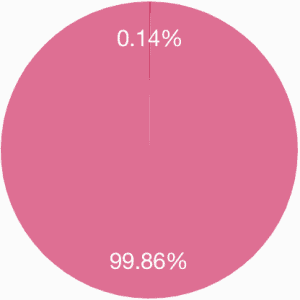

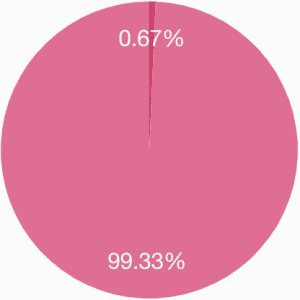

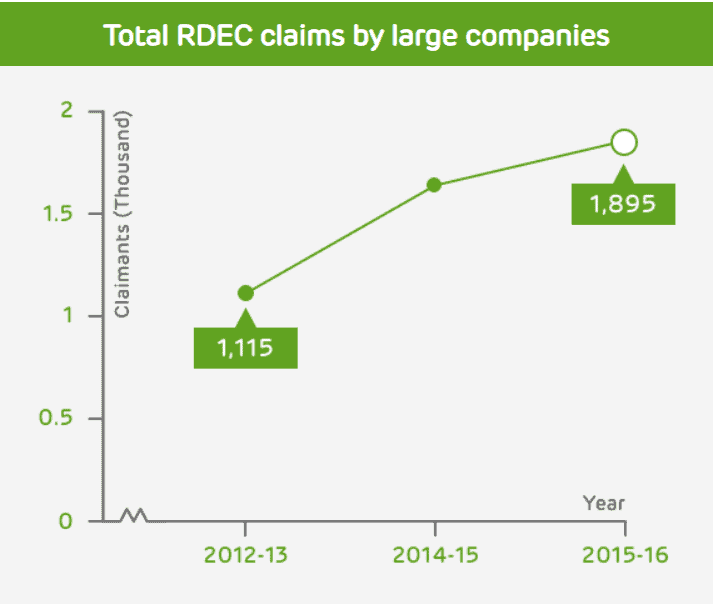

The introduction of RDEC has been successful

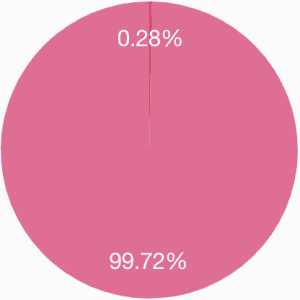

The number of large companies claiming R&D tax credits via RDEC continues to increase, following its introduction in 2013. This means RDEC has undoubtedly done its job of attracting larger firms.

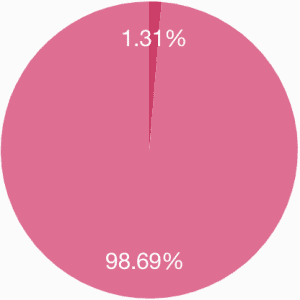

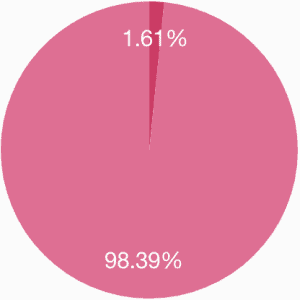

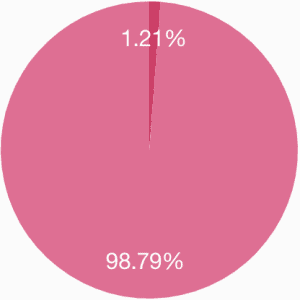

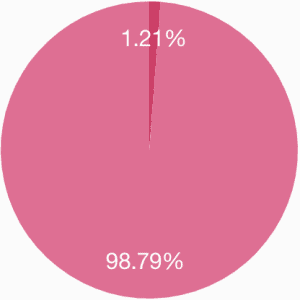

Although the rate of increase was not as large this year (13%) as it was the year before (50%), it should be seen in the context that over 99% of UK businesses fall into the SME bracket. Therefore there are simply fewer large companies in total and we cannot expect the initial rate of increase to continue at the same pace.

Trend four:

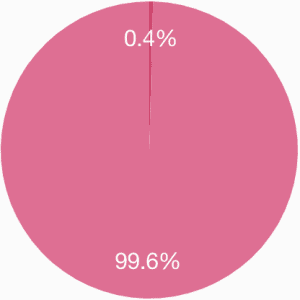

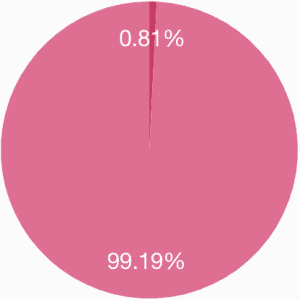

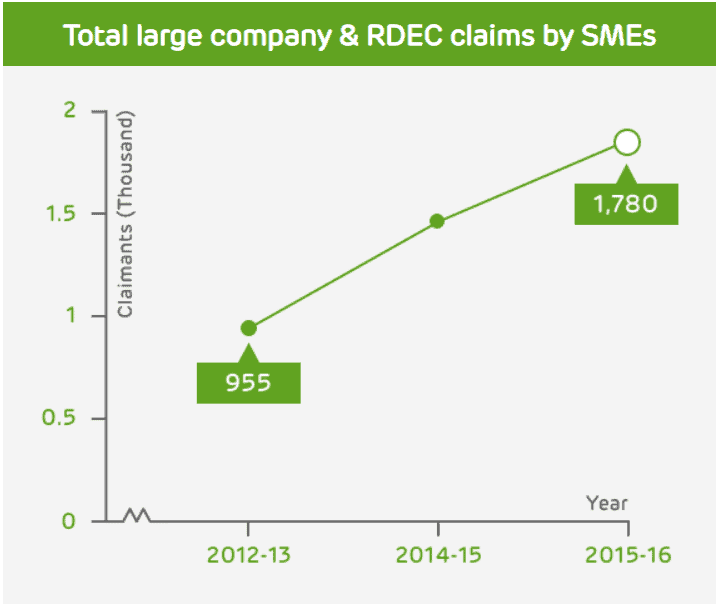

RDEC is doing its job

The success of RDEC is most evident when we look at the use of the large company and RDEC schemes by SMEs. An SME might make a claim via one of these schemes, if for example, it had received a grant or it undertook R&D as a subcontractor.

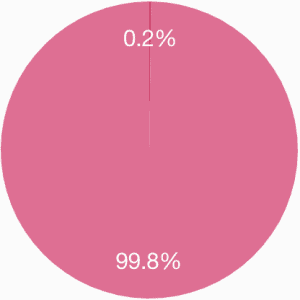

After eight years of zero growth, we believe the introduction of RDEC has led to increasing numbers of SMEs claiming via the RDEC scheme (up 207% from 2012-13 to 2015-16). The amount of relief claimed has seen meteoric growth – up 850%.

The opportunity for R&D tax credits

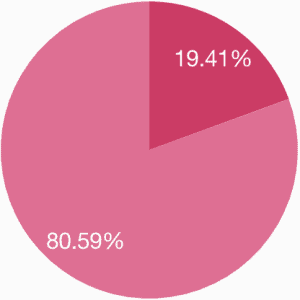

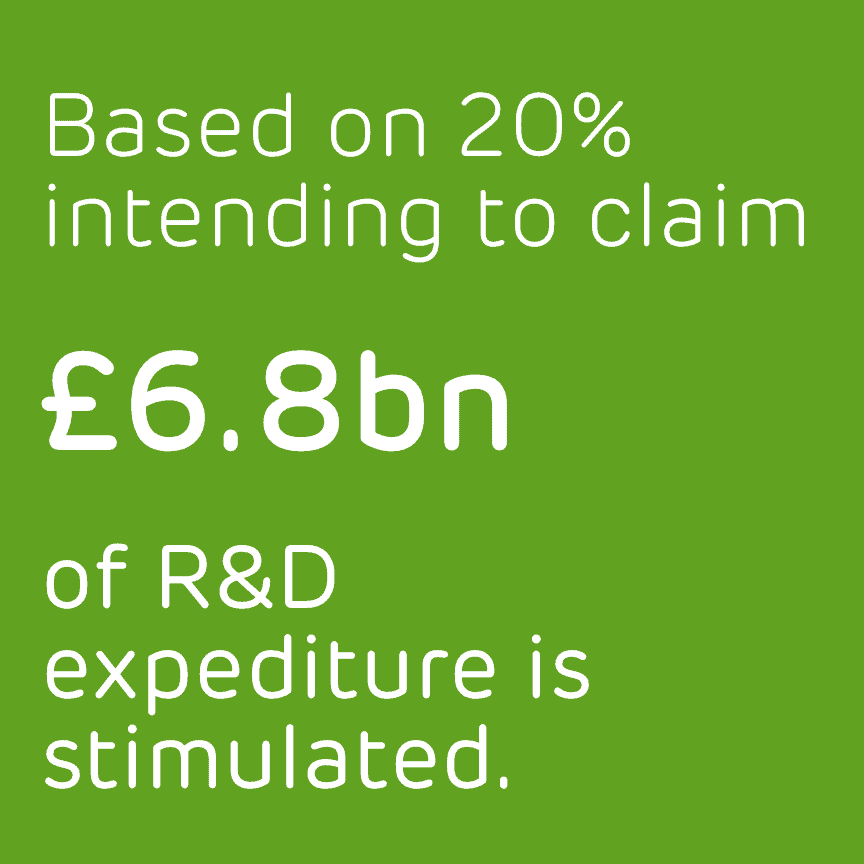

At this time last year, we published research that found that whilst 80% of companies intended to innovate in the next three years, only 20% were intending to make an R&D tax credit claim. This discrepancy represents a big gap to overcome.

We already know that those claiming could collectively be contributing up to £6.8bn per year to the UK economy. If we can close this claim gap, the remainder could add a further £27bn in R&D investment.

To do so, we need to increase awareness of R&D tax credits. How do we do this?

HMRC’s R&D tax credits statistics 2017 show that companies have embraced RDEC since its introduction in 2013. Interestingly, it is SMEs who have proven beyond a doubt that they are not put off by a new scheme.

We believe the success of RDEC is the big story this year and a big opportunity for the future.

The benefits of RDEC

RDEC was designed to ensure that both profitable and loss-making companies could benefit from R&D incentives – and it’s popularity can be attributed in part to this.

RDEC is more independent of the company’s tax position, and the benefit a company is likely to receive is easier to forecast. In this way, it provides far greater stability compared to the previous large company scheme and the SME scheme. This makes it easier for companies to factor R&D relief into their investment decisions.

RDEC for all

Introducing the RDEC model for SMEs and large companies alike would reduce the overall complexity of R&D incentives. The government would still be able to target relief to SMEs. It could offer an SME RDEC rate to deliver a benefit comparable to the current SME R&D scheme.

We believe this change would similarly increase the number of claims made by SMEs for the same reasons as it has done large companies so far. Ultimately, RDEC for all offers a more attractive way of positively influencing investment decisions and in turn, would boost the overall level of R&D activity in the UK.