Speak to our team

There’s no one-size-fits-all approach to accessing R&D tax advice. At ForrestBrown our team of experts adapt our tried-and-tested methodology to fit your business. Get in touch with James Dudbridge in our specialist advisory team to discuss our R&D tax consulting services.

- Telephone

- 0117 926 9022

What counts as R&D in the aerospace and defence industry

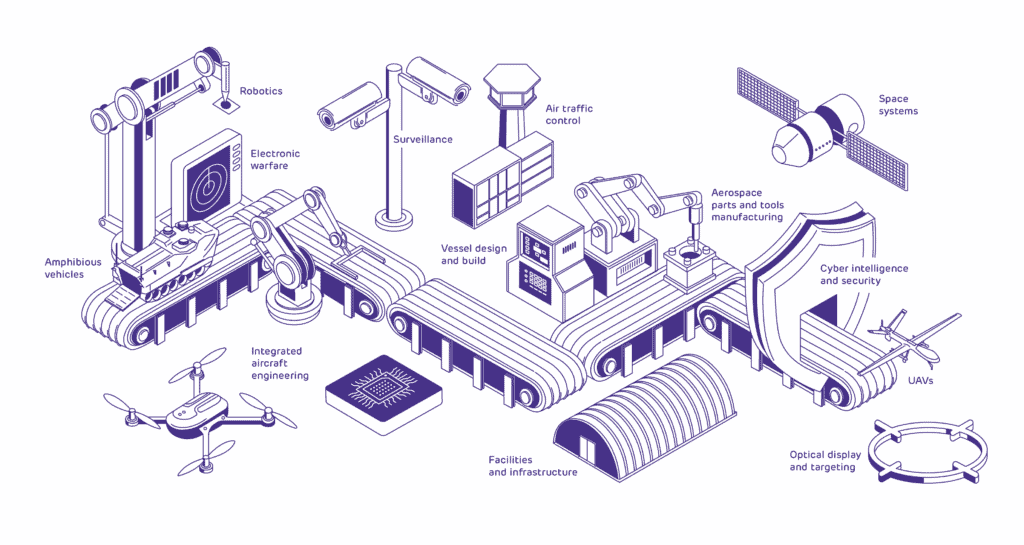

The far-reaching application of aerospace and defence technologies means the range of activities qualifying for R&D is broad.

From materials development to naval architecture, surveillance drones to innovative robotics projects, the scope for innovation is widespread and diverse.

Innovation in aerospace and defence

Prototypes

- Development and testing of new equipment and vehicles

- Innovative ground trials

- Developing synthetic environments and simulations

- Emerging stealth, survivability and underwater capabilities

Data and analytics

- Systems enhancements

- Cost and weight reductions

- Digital model verification testing

- Reliability assessments

- Internally developed software solutions.

- Enhancements to cloud-based computing integrations

Software, advanced systems, and machine learning

- Improving smart contingency management capabilities

- Refining of advanced information technologies

- Innovation applications of model-based systems engineering (MBSE)

- Trials with air traffic management AI

Unmanned Aircraft Systems

- Development of new lightweight materials

- Advancing complex sensors

- Increases to battery power

- Automotive development

- Ground station cyber security protocols

- Analysis and testing Integration with air traffic management systems

Aerospace and defence advice tailored to you

Want to be certain that all of your aerospace and defence R&D investment is being rewarded? Arrange a consultation with Peter Beavis or a member of his sector team today to make sure you’re getting maximum value.

- hello@forrestbrown.co.uk

- Phone

- 0117 926 9022

- Highly experienced materials scientist.

- Background in food science, pharma and defence.

- Doctorate in organic chemistry.

Examples of R&D in the aerospace and defence industry

From disruptors to global group companies, ForrestBrown helps innovative aerospace and defence businesses to grow. Recognised for our industry expertise and technical prowess, our on-demand advice goes beyond expectations to match even the most ambitious business objectives.

An aircraft design and development business

ForrestBrown’s FB Consulting team provided specialist advice to this innovative modular aircraft business on their commercial contracts and handling capital expenditure.

Maritime technical consulting firm

ForrestBrown’s FB Consulting team provided strategic tax advice, identifying opportunities following a review of their in-house prepared claims for this international design, engineering and risk management consultancy.

A UK airline

ForrestBrown has helped this British airline claim upwards of £250,000 for their work on propeller design improvements.

A product technology engineering

This client delivered a project to build a supersonic wind tunnel with high flow velocities and in a size suitable to be housed within a university. Resulting in a benefit of £100,000.

Google review

What sets ForrestBrown apart is the breadth and depth of their expertise: this enabled them to understand our business and our technology challenges in detail very quickly, which in turn made the engagement process very efficient for our busy team.

A high performance computing firm

ForrestBrown helped this south west business claim RDEC for their project seeking to achieve an advance in composite computational fluid dynamics modelling systems.

Google review

Working with the team at ForrestBrown was a dream. They were exceptionally helpful, friendly and professional throughout the process.

Tyler Buchan, Chief Financial Officer, Pryme Group

Proactive communication is absolutely key. With so many changes to legislation, it is very helpful that ForrestBrown keeps us up to date on the landscape for R&D tax relief.

Why choose ForrestBrown?

We’re passionate about the transformative power of R&D tax relief for your business. Our approach is adviser-led, technology-enabled, offering a range of services to suit your goals. We help aerospace and defence companies improve the quality of their R&D claims with minimal demands on their time.

Your innovation is as unique as your business. At ForrestBrown we don’t take a one size-fits-all approach to R&D tax advice for aerospace and defence industries. We have the sector expertise to help propel your growth and fuel your ambitions.

Innovation in aerospace and defence – the value of R&D tax relief

Pioneering innovators in the aerospace and defence industry can secure significant benefit through R&D tax relief.

The demand for complex and advanced solutions to both long- and short-term challenges is increasing rapidly. Ensuring your R&D cost base is effective and strategic has never been more vital.

The preparation of R&D tax claims in-house or via low fee R&D advisers is likely costing your company too much valuable time. In-house teams may not have the specialist skillset to identify all forms of R&D that intersect projects. Likewise, a low-cost provider will take a generalist approach without the expert input of sector specialists.

In such a fast-moving and competitive sector, you need to be confident that every qualifying aspect of your R&D is being rewarded and that your claim can withstand scrutiny from HMRC.

Assembling the best team for you

Our proven combination of chartered tax advisers, accountants and industry-experienced science and technology specialists bring unmatched expertise to your business to help you secure the funding your business deserves.

Our aerospace and defence specialists’ boast unrivalled insight into R&D in the industry. We pride ourselves on delivering excellent technical tax advice in plain English to provide you with practical and actionable business outcomes tailored to your needs.

Katy Long CTA CA

Associate Director

Katy Long CTA CA

Associate Director

- Qualified chartered tax adviser and chartered accountant.

- Experienced working with portfolio of large companies.

- Expert in R&D tax policy and legislation.

Expertise & specialisms

- R&D tax policy

- Overseas R&D rules

- Merged scheme

Beginning her career with a Big Four firm and gaining experience across a range of auditing and tax roles, Katy has specialised in R&D tax relief since joining ForrestBrown in 2019.

During a time of unprecedented change, Katy has led ForrestBrown’s approach to key policy developments including restrictions on overseas R&D activities and HMRC’s introduction of an Additional Information Form. This has included liaising with HMRC, delivering internal training and providing insights to clients.

Clients working with Katy benefit from her commercial mindset and deep knowledge of R&D tax relief, including how it can work alongside other innovation incentives. She works with a range of large and complex businesses in sectors including manufacturing, financial services and aerospace, where she is a trusted adviser on the RDEC incentive.

Katy co-authored the Tolley’s Tax Digest on R&D tax relief and has contributed articles to publications including Taxation and The CFO.

Peter Beavis PhD CSci CChem

Senior Sector Specialist

Peter Beavis PhD CSci CChem

Senior Sector Specialist

- Highly experienced materials scientist.

- Background in food science, pharma and defence.

- Doctorate in organic chemistry.

Expertise & specialisms

- Novel polymers and materials

- Food science

- Defence

- Pharma

Peter’s experience ranges from getting a PhD and MSci in Chemistry and improving confectionery shelf-life to the invention of a patented elastomeric material for improved radiation stability.

His career started with a role as a chocolate scientist at Mars. That was followed by a move to the defence sector, where he finished a nine-year stint as a Senior Materials Scientist at the Atomic Weapons Establishment.

During that period, he authored numerous scientific papers and spoke at international conferences on the synthesis and characterisation of novel polymers and materials. With ForrestBrown, Peter has also been published in The Manufacturer, The Medicine Maker, Interplas Insights, and the Confectionery Production publications.

That scientific and technical capability allows him to quickly understand, challenge and assess clients’ work against the R&D tax credit guidelines. And, it’s seeing the projects companies are able to fund due to the value of their claims – and the excitement they have – that’s driving him.

At ForrestBrown, Peter provides expert peer-to-peer communication for our clients on their technical projects, helping to translate their work into reports for HMRC. Examples of his work include reviewing a claim prepared by a Big Four accountancy firm – and significantly increasing the value of R&D tax relief to their business.

Pete works with our network of associations in the food and drink sector, using his background at Mars as a chocolate scientist to help businesses identify their hidden R&D in this industry. Supporting the activities of our partnerships team, Pete speaks at events, networks with businesses and hosts webinars with industry partners to raise awareness of the value of working with ForrestBrown’s expert multi-disciplinary team to access this valuable incentive.

With an infectious passion for all things science and materials, you can talk to Peter about pharma, food and drink, materials (adhesives, polymers and manufacturing) and engineering sectors.

James Dudbridge LLB

Director

James Dudbridge LLB

Director

- Leads our tax advisory practice, FB Consulting.

- Solicitor specialising in corporate and personal tax.

- Track record of success at first-tier tribunal tax chamber.

Expertise & specialisms

- Complex corporate structures, including international groups

- HMRC disputes including compliance checks and appeals

- UK tax law

James leads our tax advisory practice, FB Consulting, providing award-winning R&D tax relief expertise to businesses and accountants. This can include modelling and forecasting, risk profiling and benchmarking, and advice on compliance and methodology for large corporates.

With a legal background and extensive experience dealing with HMRC, James brings incisive insights to tax disputes, developing strategies to achieve the best possible outcome for clients. For example, he successfully led ForrestBrown’s support for Quinn (London) Limited in a 2021 landmark tribunal case challenging the interpretation of subsidised R&D expenditure.

James and the FB Consulting team provide specialist advice, working alongside a company’s general advisers, including due diligence relating to R&D tax relief pre and post transactions and R&D in complex, international groups.

A solicitor who specialises in tax advice for corporates and individuals, with a focus on cross-border and international issues, James trained and qualified at a top London law firm before relocating to Geneva to help set up the firm’s Swiss office. On returning to the UK James worked in the tax team of a leading Bristol and London-based law firm, before joining ForrestBrown in 2019.

James has contributed commentary on R&D tax relief and tax disputes to publications including Bloomberg Law and International Tax Review.

Mark Andrew

Senior Tax Specialist and Former-HMRC Inspector

Mark Andrew

Senior Tax Specialist and Former-HMRC Inspector

- More than four decades of tax experience.

- Provides strategic advice through our advisory and enquiry support services.

- Specialist in R&D tax since 2006.

Expertise & specialisms

- HMRC inspections

- UK taxation

- Training & development

Mark is a former HMRC tax inspector with more than four decades of experience. That includes time working as an inspector in HMRC’s R&D units, providing Mark with indispensable insight on the implementation of the incentive.

Joining HMRC in 1979, Mark went on to specialise in conducting enquiries into companies. He was one of the original tax inspectors assigned to the specialist R&D units in 2006, working in the Croydon unit until 2018.

He joined ForrestBrown in 2019 and his expertise is primarily shared through our enquiry support service, which provides support to clients as well as companies who have prepared claims themselves or through another adviser or partner.

The wealth of experience gained through the combination of public and private sector roles has proved invaluable so far. He helps reassure ForrestBrown’s clients, providing them with a measured viewpoint and advice on their risk profile.

Part of Mark’s drive is the challenge of debating technical issues involving the law. That includes working on Quinn’s landmark tribunal case, which tackled HMRC’s interpretation of the amount of relief available to SMEs for customer-led R&D projects.

In addition to his work in enquiry support, Mark contributes to our in-house development programme, the Learning Lab, which aims to create the next generation of tax professionals.

Find out about a typical day for Mark Andrew in our meet the expert series.

Robin Taylor BEng MIED

Senior Sector Specialist

Robin Taylor BEng MIED

Senior Sector Specialist

- 20 years’ mechanical engineering expertise.

- Specialist in automotive body and electromechanical systems.

- Plays a key role in optimising engineering R&D claims.

Expertise & specialisms

- Mechanical and electromechanical engineering

- Automotive engineering

- Leadership

- Design

Robin is an accomplished mechanical engineer who has worked for some of the world’s most iconic companies. With two decades of industry experience, his knowledge is integral to optimising engineering claims.

After studying Automotive Engineering at the University of Leeds, Robin began his career with a Tier 1 supplier to the automotive industry. He spent five years at this manufacturer developing sealing systems for companies including Toyota, Honda and Aston Martin.

He moved to Bentley Motors and broadened his experience to whole closure systems, including bonnets, doors and tailgates. During this time Robin worked on vehicle projects such as the Mulsanne, Flying Spur, Bentayga and continental GT.

Ten years on, Robin moved to Dyson to work on their electric vehicle project, where he was the engineering manager for closures. As part of this role he managed a large team and had ownership of the body test facility. Several uniquely innovative designs were produced, including several registered for patents.

Robin not only helps our engineering clients, but also works with our wider network of automotive and mechanical engineering industry associations. As a member of the Niche Vehicle Network, Robin draws on his industry experience to support fellow members on the value of their R&D projects; speaking on webinars, joining networking events and participating in sharing insights in industry publications, such as his piece in Automotive Testing Technology International.

Robin brings this wealth of mechanical and electromechanical engineering experience to ForrestBrown. As one of our sector specialists, he helps client companies to articulate precisely where the activities which qualify for R&D tax relief occur. Robins helps to ensure that the technical part of each claim is robust.

Speak to our expert team today

We’re passionate about helping our aerospace and defence clients access the valuable funding their innovation deserves. Speak to our team to find out more.

- Telephone

- 0117 926 9022

- hello@forrestbrown.co.uk