Choice is a good thing. Choice allows us to choose the right products or services suited to our needs, when and where we need them. The R&D tax advice market is brimming with advisers big and small.

But choice has its downsides, too. As consumers, it’s largely up to us to pick the right service or product for us and our business. Sometimes we make a bad decision. And that’s OK if the choice extends to a brand of coffee or a new shampoo – but in tax advice, errors and bad decisions are altogether more costly.

ForrestBrown is keen to ensure businesses have all the information needed to make good decisions. There are quite a few R&D marketing myths and fibs swirling out there.

The market is competitive, and the incentive is quite lucrative. As such, advisers make eye-catching claims to stand out online. Not all these claims are necessarily irresponsible or bad (although some are downright misleading). But engaging with these claims requires a measure of reading between the lines.

R&D tax marketing myths

Knowledge is power, as the old expression goes. In this article, I will cover some common marketing messages promoted by R&D tax advisers. Some require additional context to properly understand, while others are simply hogwash.

‘100% success rate’ and ‘approved claims’

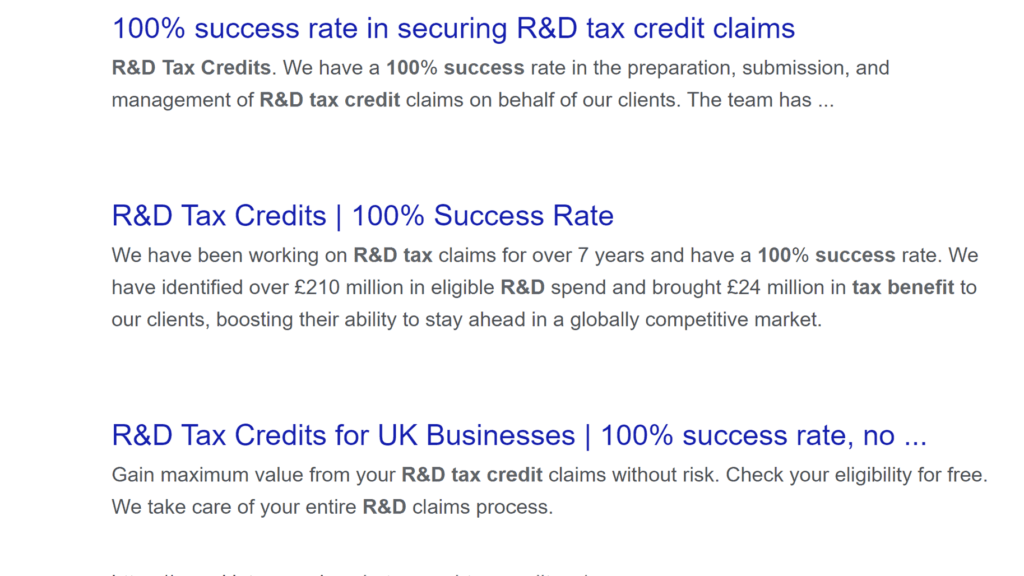

Do some research into R&D tax advice on Google, you might notice one statistic pop out at you again and again:

Good news, then! There’s a lot of success in the R&D tax advice market. Not just success, in fact: 100% success. Nothing beats perfection, after all.

Sarcasm aside, the first question we need to ask here is: “What do we mean by ‘success’?”. As our technical director Jenny Tragner points out, one adviser “explained recently that for them it means that every claim they have submitted has been approved”.

The key word here is ‘approved’. As Jenny explains: “If HMRC processes a claim, it has not been ‘approved’.” It’s a word that has no specific meaning for the purposes of Corporation Tax self-assessment.

In self-assessment, your claim is right until HMRC challenges it and find it to be wrong. The only way an adviser could purport a claim to be ‘approved’ is if HMRC initiated an enquiry and then okayed it. So is “100% success rate” just a charitable way of saying every single claim you put together is subjected to HMRC enquiry? I would certainly hope not.

For you, the claimant, this message creates the illusion that HMRC approves every claim as it is submitted. This is absolutely not the case. Your adviser can submit a spurious, error-riddled claim on your behalf (and you could even receive your credit) only to be caught up in a costly, difficult HMRC enquiry later on.

90% of the business decision-makers don’t know that R&D tax advice is unregulated, according to research conducted by YouGov. Download our full report to read more about protecting your business.

How to challenge these marketing messages:

- What do you actually mean by ‘approved’ or ‘success’?

- Does/will HMRC really approve my claims?

‘Risk-free’

It’s hard not to feel a pang of empathy when I see advisers make this claim. That’s because many of us who do this job are genuinely passionate about R&D tax relief. We’ve seen first-hand the difference this incentive can make to businesses.

This passion means advisers are keen to get as many eligible businesses as possible to claim. As such, it’s a common refrain in marketing to emphasise that the incentive is a safe, established and government-backed funding source.

Sometimes, however, passion spills over into over-zealous messaging. Namely, when advisers claim R&D tax relief (or any facet thereof) is “risk-free”. This is, quite plainly, nonsense.

A reputable adviser will do everything possible to mitigate the risk of an HMRC enquiry – but it’s an eventuality that cannot always be avoided. Some claims prepared by ForrestBrown – although not many – go into enquiry.

When that happens, enquiry support is included in your service contract. We work tirelessly on your behalf to resolve the claim quickly and amicably. R&D tax relief is low-risk when claiming with a reputable adviser (not risk-free). And if risk, can’t be entirely avoided, enquiry support as standard should be your emphasis.

How to challenge this marketing message:

- How will you support me if my claim is subject to an HMRC enquiry?

- What expertise do you have on your team to support with the resolution of an enquiry?

- What are the risks to my business?

- How do you protect my business from risk?

‘HMRC approved methodology’

As we’ve pointed out at great length elsewhere, HMRC doesn’t even regulate the tax advice market. Let alone ‘approve’ any one firm’s methodology.

That’s not a slight on the tax authority, mind you. HMRC simply cannot approve every claim and the energy of its staff is better spent elsewhere (like circumventing abuse of the tax system).

Any adviser claiming that its methodology has received HMRC’s blessing is playing fast and loose with the facts. A claim methodology is a good thing for any R&D tax adviser to have – but its effectiveness has been attained through years of experience and sector specialist insight, not HMRC ‘approval’.

An adviser should discuss its claims methodology with you in detail. Not wave the question away with an ambiguous (or downright misleading) reference to HMRC’s approval of how it works.

How to challenge this marketing message:

- Do you have relevant sector specialists involved in your claims process?

- What is your internal QA process?

- Does your process involve any DIY spreadsheets or legwork on my behalf?

Enquiry rate statistics

Another common percentage statistic – albeit far more reasonable than ‘100% success!’ – is the HMRC enquiry rate. That is the percentage of claims (either annual or total) that have been subject to HMRC enquiry.

On its surface this claim might seem simple but, in reality, it skims over all sorts of complex considerations. When calculating HMRC enquiry rate, does the adviser include claims where the adviser has prepared the whole claim? What about where they have provided consultancy to support the claim? Is their statistic based on the number of claims they have prepared, or the value of relief claimed?

An increasing number of companies approach ForrestBrown for support in resolving an enquiry after it has been opened. Where would this feature in either our or their previous adviser’s statistics?

What if the adviser has only been in business for 12 months – their enquiry rate might be zero, but what does this say about their competence?

R&D enquiries can also be part of a wider tax enquiry. Advisers who tend to work with larger, more complex businesses will deal with enquiries more regularly. Should they be considered less competent because of this or the opposite?

How to challenge this marketing message:

- What sort of businesses do you work with?

- How do you calculate your enquiry rate?

- If my claim is subject to an enquiry, what support do you offer?

Cheaper than the competition

Look, we all love a bargain and there is absolutely a time and place for cheap. R&D tax relief is definitively not the right place to go bargain hunting. Tax advice is a highly specialist endeavour with serious implications if things go wrong.

Any claims about ‘cheap’ or ‘cheapest’ should be regarded with caution. Of course, you don’t want to (and shouldn’t!) spend over the odds for excellent tax advice. But putting together a high-quality team of tax advisers and sector specialists is an investment.

Whenever an adviser makes claims about low fees, then reasonable doubt must be cast either on the composition of their in-house team or their process. Somewhere down the line corners are being cut. Many advisers use software to automate key tasks in filing an R&D tax relief claim. Software isn’t bad, in and of itself – but it should be used to enhance claims, not cut costs.

How to challenge this marketing message:

- Why are your fees so low?

- What do I receive for that small fee?

- What work do you expect my team to undertake?

- How do you ensure that my R&D claim is correct?

Cutting through the noise: How to pick the best R&D adviser

Any marketing message presents an idealised version of the thing it is promoting. And that’s mostly fine. We certainly can’t expect an advertisement for shoe polish to list out caveats and exceptions. But I’d argue that tax advice sits quite outside the realm of the normal consumer product. Too often, tax firms gloss over the nuances and complications inherent to our industry.

I’m aware, however, that these trends will not go away. The focus then should be educating people about how to engage with these messages effectively. That’s what this article has attempted to do.

If you’re considering any R&D tax advice service agreement, the following key things are worth considering:

- Scope of work – What’s the full scope? Many advisers limit their time commitment by pushing work to you.

- Fee calculation – how is the fee for R&D tax advice calculated? Some advisers charge upfront fees or include additional fees in the small print.

- Contract term – is it a multi-year R&D tax credit contract? Some service contracts can be multi-year with penalties for early termination.

- Corporation Tax return – Who handles the Corporation Tax return? This is an important step and should be your choice as to whether your adviser or your accountant handles it.

- R&D enquiry support – what does your contract say about HMRC enquiry support? ForrestBrown’s enquiry support service is included in our contract terms as standard.

Excellent service on your terms

ForrestBrown’s only priority is doing excellent work for you – and we can do this work on your terms. Our tax advisers and sector specialists can provide an end-to-end claim or work with you on a consultative basis. Contact us today to find out more.

- Telephone

- 0117 926 9022

- Hello@forrestbrown.co.uk