In a time when cash flow is a focus for many, I’m well aware it’s tempting to go with the cheapest option. Indeed, in a tough economic landscape, cost-cutting has its place and I absolutely understand the compulsion to plump for the lowest price.

But while there may be times where choosing the budget option is appropriate, I’d argue it’s not a good approach when it comes to R&D tax credits. In R&D tax advice, there’s a dazzling array of choice when it comes to fees and prices. To help you make sense of it all, I will break down the most common fee structures.

Importantly, I’ll explain why ‘cheap’ or ‘cheapest’ is not the best way to choose a provider, and what you should look for instead.

ForrestBrown fees

First, a quick word about ForrestBrown’s fees. We aren’t the cheapest R&D tax credit consultant. To be clear, we absolutely offer a competitive price for our services, but we’re also not interested in a race to the bottom on R&D tax credit fees.

Our primary emphasis is delivering technically excellent work for our clients. That’s why ForrestBrown has invested, and continues to invest, in a multi-disciplinary team of chartered tax advisers, industry sector specialists and former HMRC R&D tax credit inspectors. This level of specialist expertise requires investment, and that’s reflected in our fees.

If an R&D tax adviser is charging a bargain price, then that adviser will need to dilute its service in some way to survive. As I explained in Accountancy Age, R&D tax credit advice is only partially regulated. This leaves the industry particularly prone to unscrupulous providers making big promises while cutting corners.

Regulated advisers are subject to a detailed code of conduct, which informs how they structure their business and services. Examples include having ongoing training programmes for staff, following proper AML processes, and ensuring the confidentiality of client data.

All are processes designed to protect clients. Unregulated advisers do not have to follow these rules and can, therefore, choose not to if it saves them money.

How R&D tax credit fees work

Often, an R&D adviser’s tax credit claim fee will be a percentage of whatever amount you receive from the government, so-called ‘no win, no fee’. Depending on your specific requirements, ForrestBrown’s fee for preparing an R&D tax credit claim can be calculated on this basis, or as a fixed amount on a time and materials basis.

‘No win, no fee’ – an ugly term, but a useful description: Decades of ambulance-chasing TV adverts have tainted the phrase ‘no win, no fee’. But the term remains useful as a succinct description of how many R&D tax credit advisers charge for their services. Don’t be intimidated: ultimately, this fee structure means it costs nothing to find out whether you can benefit from R&D tax credits or not.

This R&D fee structure is a higher risk for the adviser, but it also enables them to be more flexible in their approach. If the claim value is low, the adviser may not recoup all its costs but they still need to deliver a claim, and a reputable adviser will do everything necessary to ensure that claim is robust.

Conversely, if the claim value is high, the adviser might realise a healthy profit margin. As the business is also benefitting from a higher value, this is often considered a win-win.

That said, this model isn’t inherently good, either. Its simplicity makes it prone to advisers attempting to undercut the rates of competitors. It’s tempting to simply opt for the provider that’ll take the lowest cut, but if it seems too good to be true, it probably is.

A percentage fee is still based on the time and resources that an adviser believes are necessary to deliver the work. A very low percentage makes it more likely that they will need to use fewer resources, or less experienced staff to deliver the work commercially.

In a percentage fee arrangement, you often don’t have full visibility of the team who will be advising you – so I’d always recommend asking. And make sure you have a clear understanding of what is in and out of scope; discuss this with your adviser before signing any contract and always make sure you read and understand the terms of business.

If you’re not sure what you’re getting, or if the sales pitch sounds different to what’s in the paperwork, then it’s much safer to look elsewhere.

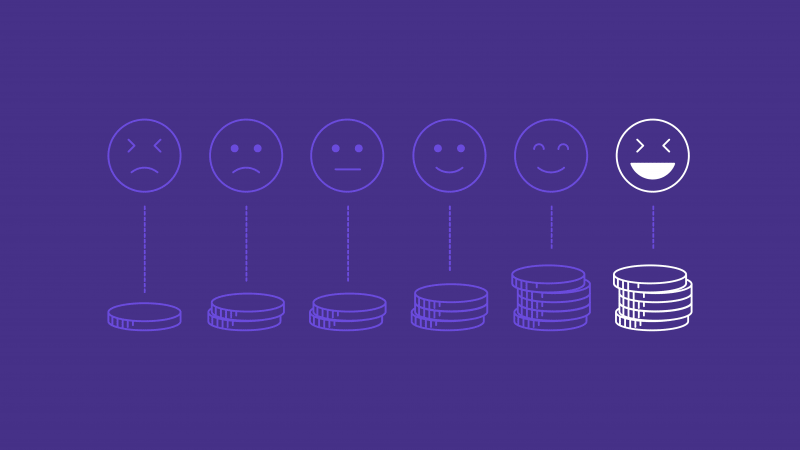

Like most things in life, with budget prices, you often get what you pay for. With R&D tax credit advice – indeed, any tax advice – it’s better to focus on value than price. A good adviser will dedicate the time, expertise and resources necessary to improve your claim.

A lower percentage of an undervalued claim is clearly not a win. But value isn’t just about the size of your claim, it’s also about how your adviser protects you from risk and how they work with your team to streamline the claim process.

Other R&D claim fee structures

Success fees are common, but they aren’t the only option available and they aren’t suitable for every scenario. Some advisers cannot work on a percentage basis with certain clients due to audit restrictions. Others just prefer different fee structures or want to offer flexibility for their clients. At ForrestBrown, we opt to be flexible because we believe a holistic approach for each client is the best way to deliver value.

- Fixed fees:

A flat fee agreed in advance offers certainty and tends to come with a clear scope of work. There’s no financial incentive on the adviser to maximise the value, but equally no danger of inflation. (Although neither of these is an issue for a reputable adviser!). The client knows how much they will pay for the services provided by the adviser, but, unlike a contingency arrangement, they will pay regardless of the value of the claim to them. Like all fees for advice, fixed fees tend to be based on the time and resources the adviser thinks will be needed to deliver the work, although there may not be a detailed budget agreed for the work. When operating on this basis, there should be a good level of transparency between client and adviser, with the client understanding the scope of work, who will be providing advice, deliverables and the measure of success (including the timing of the invoice!). - Time and materials:

This arrangement flexes the fee to the time input, so can offer the client more control over fee levels by taking more of the work on themselves. However, a time and materials fee also leaves the client exposed if open-ended and can adversely affect the client-adviser relationship if there are unexpected overruns. Time and materials fees can also apply different pricing for different skillsets or levels of expertise, so it could be tempting to cherry-pick less experienced resource to save cost. However, a regulated adviser cannot give work to a staff member who is not competent to deliver it. Time and materials arrangements work well when there is a good level of trust between adviser and client, as communication is key to avoid surprises. - Upfront fee:

An upfront fee allows an adviser to cover some of their costs for preparing a claim before the start, or early in the engagement. Under a contingency arrangement, fees are not typically charged until the R&D claim has been processed by HMRC, which can be several months after work began on the claim. Watch out for these terms if you are comparing different advisers. They aren’t a hallmark of a spurious adviser, but they are a clear example of where terms can look similar at a high level but differ materially when you read the small print. - Restricted success fee:

Some percentage arrangements look comparable but aren’t, and it often takes a detailed review of the terms of business to spot the differences. At ForrestBrown, where our fees are based on a percentage of the benefit of a claim, that benefit is always the actual benefit, which we calculate for our clients, and we check that this reconciles with the amount received. If you are comparing advisers, check the small print to ensure this is the case, or are they making assumptions about your benefit when calculating fees? Also, check when the invoice will be raised. One adviser may be cheaper than another but charge you as soon as the claim is submitted, rather than waiting until you receive the benefit. A cashflow point only perhaps, but in 2019 HMRC were taking upwards of nine months to process some R&D claims.

How to choose an R&D tax credit adviser

So if you can’t use price as an accurate indicator, what can you use to help discern the good from the bad?

To help, here are nine questions a reputable R&D tax credit adviser should be able to answer positively (at a bare minimum):

- Do they have PI insurance and are they registered for AML supervision?

- Are they accountable to a relevant professional body like the CIOT, meaning they adhere to the PCRT guidelines?

- Do they have sector-specific expertise on staff?

- Can they offer references and positive testimonials from clients?

- Do they adhere to HMRC’s agent strategy guidelines?

- Do they avoid generic questionnaires and templates?

- Will they visit your business in person? (despite this not being possible for the time being, you should still expect quality engagement – like a video conference perhaps.)

- Will they explain their findings and share their final reports with you for approval?

- Will they share findings with your accountant?

If the adviser is not able to answer ‘yes’ to all of these, you need to stop and think carefully. Sure, they might offer a low price but it could mean dangerous corners being cut or a lack of specialist expertise.

In addition to the above, you can find out what the Professional Conduct in Relation to Taxation (PCRT) guidance is doing to prevent spurious R&D advisers.

ForrestBrown’s approach to R&D tax credit advice

To my mind, those ten points outline the minimum acceptable standard any adviser should satisfy. As the UK’s leading specialist R&D tax credit adviser, ForrestBrown strives to go far beyond just the bare minimum.

At ForrestBrown, we:

- Have a multidisciplinary team including qualified chartered tax advisers, sector specialists, lawyers and former-HMRC inspectors.

- Adhere to the latest update of the Professional Conduct in Relation to Taxation (PRCT), and were part of the working group which produced guidance specific to R&D tax advice.

- Actively contribute to HMRC’s Research & Development Communication Forum.

- Have a dedicated in-house training programme to maintain the technical expertise of our staff, and is an accredited ICAEW training employer.

- Have a specialist independent quality assurance team who oversee every claim we prepare.

We aren’t, as stated, the cheapest provider. And, in all honesty, it is not a competition we are interested in. Instead, we have formulated an award-winning approach that delivers results to our clients.

It is a professionalism that will make claiming straightforward for you or your client, that minimises risk and supports you in securing the funding you’re entitled to. For all this, we charge a fair rate.

So instead of asking why not choose the cheapest R&D tax consultant, we’d ask why not choose the best?

Interested to know more about working with ForrestBrown and how we charge for our services? Get in touch with our team today.