Where once spotting worthwhile opportunities for your client was like trying to find a needle in a haystack: ForrestBrown research suggests more and more accountants are comfortable outsourcing high-value services like R&D tax credits.

If you’re not referring clients to an R&D partner, you could be leaving value on the table. And even if you are, not approaching this proactively could mean you are still missing out on the added value, risk mitigation and time saving of R&D tax credit claims done properly. It’s time to get proactive and take a second look at your clients with the help of an expert.

Identifying clients that are eligible for R&D tax credits

Once you have warmed to the idea of outsourcing R&D tax credits, how do you know which clients to begin referring? You need to know:

- What counts as R&D

- The signs that a client may be eligible

- Some idea of what mistakes to avoid

Of course, if you’re unsure about whether a client qualifies for R&D tax credits or not, you can phone ForrestBrown and ask. Even if they are not eligible, we’ll ensure that they understand why, and help them to identify future projects which may be R&D, so they’ll know when to get back in touch.

Common signs that your client may be eligible for R&D tax credits

To help you spot their R&D, a useful exercise when preparing your clients’ years-ends is to review whether they:

- Operate in a specialist or niche market

- Work in a regulated industry

- Employ skilled or technical staff

- Take on challenging projects that involve them taking a leap into the unknown

- Solve difficult technological problems.

Your clients could be doing qualifying R&D if they have run a project that had to overcome a technical problem. If there was any doubt as to whether it was feasible, either at outset or in the course of the project, your client could well have been doing R&D. Technological uncertainty can also relate to the practicalities of the project, rather than the overall feasibility. This could be where your client is confident that something is feasible, but uncertain how to actually achieve it in practice.

Businesses are often surprised to find a body of work they considered run-of-the-mill can actually qualify. Engineers in particular often consider problem-solving to be business as usual, but often some of those problems are technological uncertainties, and their solutions qualifying R&D.

Internal projects and prototypes can also be claimed for and a project doesn’t need to have been a huge commercial success. Indeed, the qualifying research and development project may have stalled, been called off or just been an unmitigated disaster for the business’s books. There could still be R&D evident from which to recoup some of the costs.

Download our accountants’ R&D spot-check

Identifying all qualifying costs in clients that are eligible for R&D tax credits

It’s important to the R&D tax credit claim’s value to identify the full scope of qualifying costs. There are cost categories including staffing costs, subcontracted R&D, externally provided workers, consumables, software and (this one’s a bit niche) payments made to the subjects of clinical trials.

You can find more on that in our KnowledgeBank article on qualifying expenditure What costs qualify for R&D tax credits?

The legislation governing R&D tax credit claims can be complex, and it is important to partner with a suitably qualified chartered tax advisory team to ensure that these rules are applied correctly to your clients’ claims. But R&D tax credits are also unique in that they draw upon both tax knowledge and real-world problem-solving in science, technology and engineering too. That is why the R&D tax adviser you work with should have genuine sector experts on staff too.

Scenarios that complicate an R&D tax credit claim

To those unaccustomed to dealing with R&D tax credits every day, there are a few situations which might prompt a bit of head scratching. For example:

- How to accurately calculate the R&D tax credit benefit for both loss-making and profit-making businesses. And how to calculate the benefit for claims of businesses when profits fluctuate.

- How to correctly calculate claims for businesses that are part of a wider group, particularly where there are group losses, or recharges of R&D expenditure between companies.

- Accurately determining whose R&D it is when multiple parties are involved in a project.

- Understanding the treatment of subcontractors for R&D tax credits.

- Knowing what defines a large company vs SME, plus how to know and what to do with the R&D tax credit claim at company status change when one becomes the other.

- How it’s possible to use grants and R&D tax credits.

- Recognising how capital allowances and R&D tax incentives compare and interact.

- Understanding the rules around connected parties and R&D tax incentives.

Some of the more common queries we get from accountants are around the accounting treatment of R&D tax credits and surrenderable loss. We look at these two issues in more detail below.

Accounting treatment of R&D tax credits

For the SME R&D tax incentive, the accounting treatment is straightforward: R&D tax credits are non-taxable and therefore only affect a company’s tax charge.

The accounting treatment for RDEC is different, as the gross credit may be treated as income in the company’s accounts. This increases the company’s accounting and taxable profit. The credit itself lowers the company’s tax liability, or is awarded as a cash payment.

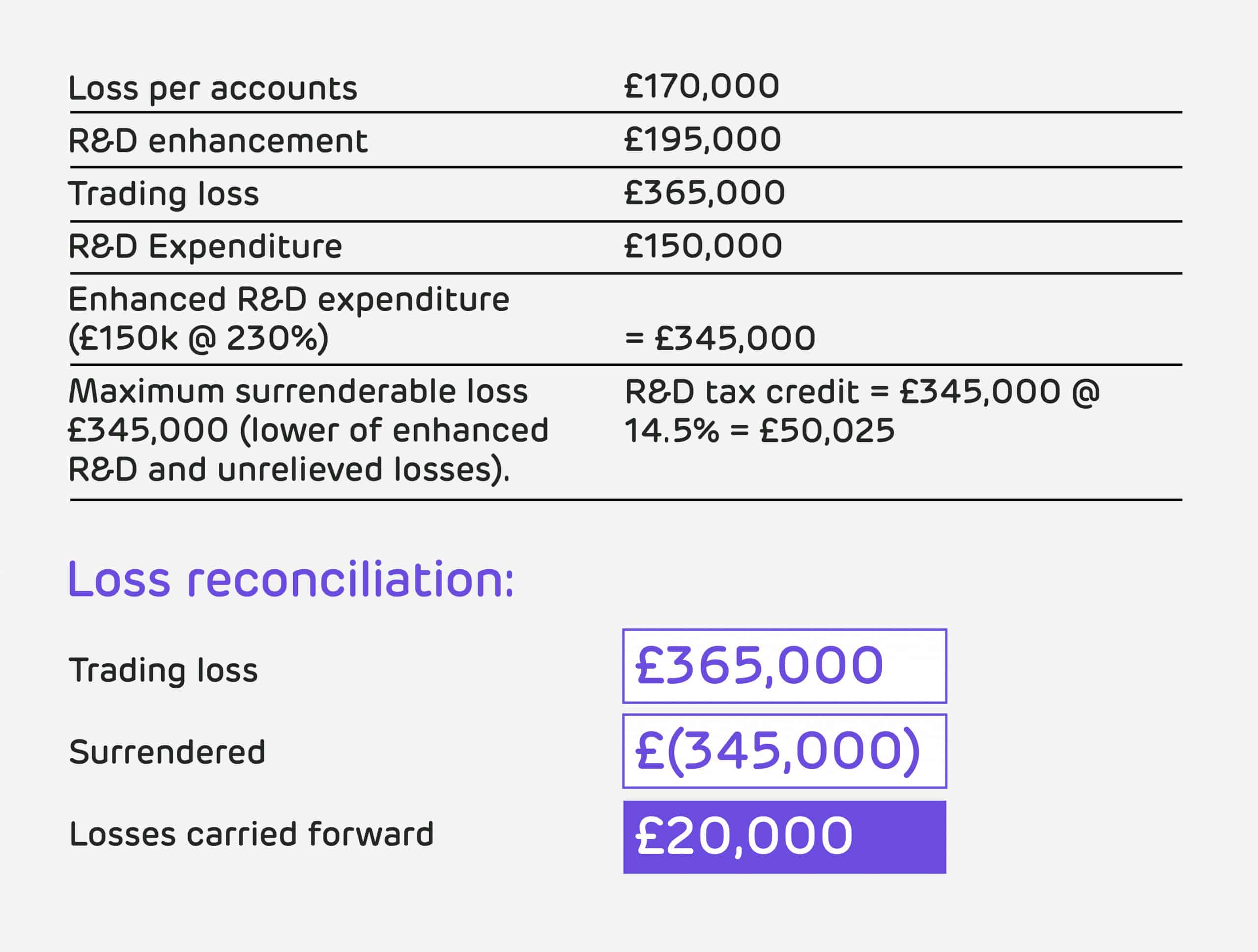

Surrenderable loss example

An SME may claim a payable R&D tax credit for an accounting period in which it has a surrenderable loss. An example of surrenderable losses can be seen below.

How to calculate R&D tax credits

With the caveat that no online calculator can replace expert R&D tax advice, you can estimate a client’s claim with our How to calculate R&D tax credits tool. Again, every client has unique circumstances both immediate and future. This may assist with your planning.

Why Partner with ForrestBrown

At ForrestBrown, we have a multidisciplinary team. Tax expertise rubs shoulders with sector-specialist engineers, scientists and software developers. Our Quality Assurance (QA) team has two former-HMRC R&D unit inspectors in it. Their insight from the tax authority is valuable at every stage to ensure every R&D tax credit claim we submit goes through the same level of scrutiny it will receive at HMRC.

Find out more about our R&D tax credit partner programme for accountants.