If you are creating a new or improved product, process or service, your business might be carrying out research and development (R&D). As an expert in your field, you will most likely be attempting to bridge a gap in industry knowledge or capability and attempting to resolve a technical problem to which no solution is immediately evident.

The definition of R&D for tax purposes, as outlined in the document published by the Department for Science, Innovation and Technology (DSIT), is purposefully broad and can encompass many different technical or scientific sectors. Whatever the size of your company, so long as you sit within a recognised technical sector as outlined at paragraphs 15-17 of the DSIT Guidelines, and your company is attempting to resolve scientific or technological uncertainties, then you may be engaged in qualifying activities.

These could include:

- Improving knowledge or capability.

- Creating a new product, device or services which incorporates an overall increase in knowledge or capability in a specified field.

- Appreciably improving an existing process, material, device or product.

You might also be trying to develop something that exists but doing so differently and without following an existing plan or process (without routinely copying a device, product or material).

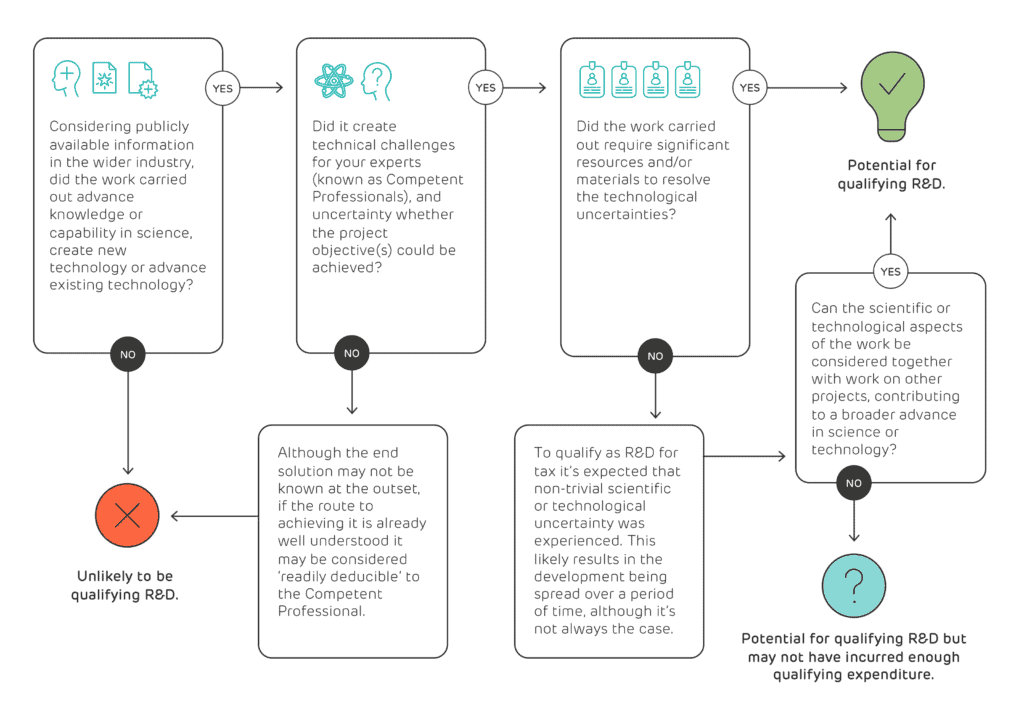

If, when you start your project, you are not sure if it is scientifically or technologically possible, or you don’t know how to achieve it in practice, you could be resolving uncertainties. The project may therefore qualify for R&D tax relief.

Read more details on qualifying costs for R&D tax credits

Boundaries of R&D: where does R&D within a project start and finish?

R&D begins when you start work to resolve a scientific or technological uncertainty and it finishes once that uncertainty is resolved. If R&D is carried out as part of a larger commercial project, activities outside the boundaries cannot be included. Technical planning and feasibility studies, commercial activities such as researching market trends and requirements, and financial, legal or regulatory work is specifically excluded.

How do I know if my project qualifies for R&D tax credits?

First, work needs to be specified in, and follow, a project. To qualify as R&D, it should set out to achieve an advance in the field, not just advance the company’s own knowledge or capability. Your project can still be considered R&D if the advance has already been achieved but the details are not readily available due to trade secrets or IP protection, for example. Or if you are trying to develop something in a fundamentally different way, to fit within your existing capabilities.

It is important to note that a project does not have to yield a positive result to be R&D. Failed projects can still be eligible, so long as you carried out the work to try to resolve uncertainties (section 38 of the DSIT Guidelines).

What type of projects do not qualify for R&D tax credits?

The main goal of the project should not be readily available or obvious to you, as an expert in your field. If you can use standard reference materials or use off the shelf components as they are intended for use, then this would be considered routine.

Generally routine copying of existing products, processes, materials, devices or services will not qualify as R&D. Work to improve cosmetic or aesthetic qualities is not in itself considered R&D, however these may be considered drivers for R&D. Work to create these effects through the application of technology may still qualify.

While technical planning and feasibility studies are generally activities that can be included in a claim, more commercial activities such as researching market trends and requirements, and financial, legal or regulatory work are specifically excluded. Furthermore, routine testing purely for validation or regulatory purposes is generally considered non-qualifying activity (however, testing as part of resolving uncertainties is a qualifying activity).

Where can I find out more?

As well as the DSIT Guidelines, HMRC has released the GfC3 guidance to aid companies in determining whether they are carrying out R&D. It has also released a new R&D eligibility tool to help guide potential claimants on qualifying activities.

At ForrestBrown, our team includes qualified chartered tax advisors, sector specialists, lawyers and a former HMRC inspector. We use a continually-evolving process to prepare R&D tax claims that meet HMRC’s high standards and are expert in offering advice and preparing claims. If you’re unsure whether your work qualifies, we can help.