If you are creating a new or improved product, process or service, your business might be carrying out research and development (R&D). You will probably be attempting to solve a problem where no solution is evident. This can take many forms. And R&D projects can include work undertaken for a client as well as your own business.

The government’s definition of R&D is purposefully broad. Whatever size or sector, if your company is taking a risk by attempting to ‘resolve scientific or technological uncertainties’ then you may be carrying out qualifying activity. This could include:

- Creating new products, processes or services.

- Changing or modifying an existing product, process or service to make it better.

This means that if you’re not sure your project is scientifically or technologically possible, or you don’t know how to achieve it in practice, you could be resolving uncertainties and therefore qualify for R&D tax relief.

Read more details on qualifying costs for R&D tax credits

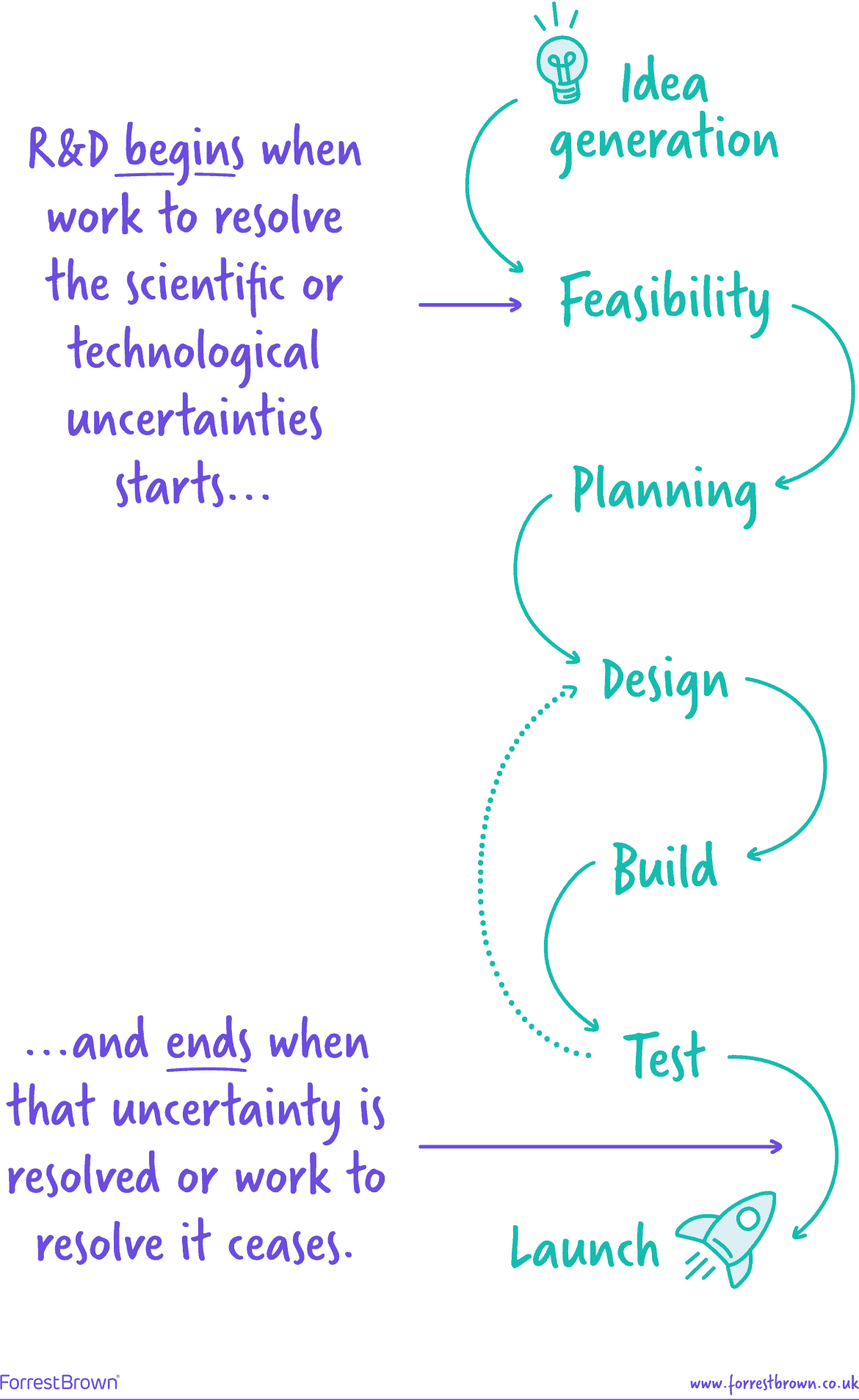

Where does R&D start and finish?

R&D work begins when a project seeks an advance in science or technology, and ends when the project’s uncertain elements have been overcome. Any user-testing or commercial marketing work beyond overcoming the project’s uncertainties will not be R&D.

How do I know if my projects qualify for R&D tax credits?

For a project to qualify as R&D, you should have set out to achieve an advance. That advance must be in the field of science or technology, not just in your company’s own knowledge. Your project can still be R&D if the advance has already been achieved but the details are not readily available because, for example, they’re a trade secret.

It’s important to remember that R&D is inevitably not always successful. If your project is ultimately unsuccessful but sought a solution which was not evident at the outset, it could still be R&D.

What kind of projects do not qualify for R&D tax credits?

Generally, routine copying of existing products, processes, materials, devices or services, will not usually qualify as R&D. Work to improve the cosmetic or aesthetic qualities of a process, material, device, product or service will not itself be R&D. However, work to create certain cosmetic or aesthetic effects through the application of technology can still qualify.

At ForrestBrown, our team includes not just qualified chartered tax advisers, but also sector specialists, lawyers, former HMRC inspectors, and even a rocket scientist!

We use a continually-evolving process to prepare R&D tax credit claims that meet HMRC’s high standards – and deliver maximum value to your business. If you’re not sure whether your work qualifies, we’re here to help.