What is the Modern Industrial Strategy?

The Modern Industrial Strategy is a 10-year plan to deliver certainty and stability to businesses to invest in high growth sectors. Eight sectors have been prioritised for growth and investment, including advanced manufacturing.

The focus will be on six industries: automotive, batteries, aerospace, space, advanced materials and agri-tech. Designated investment zones in areas such as the East Midlands and Greater Manchester will provide hubs for growth, alongside targeted AI growth zones.

The value of R&D tax relief in advanced manufacturing

Whatever your innovation, if your company is creating new technology or applying existing technologies in new and novel ways, you may be eligible to claim R&D tax relief. We can help by reviewing your eligibility, notifying HMRC of your intention to claim and processing your claim.

Opportunities for innovation

From materials utilisation to predictive maintenance, innovation in advanced manufacturing is broad. Below are just a handful of the ways in which innovation is taking shape in the sector.

-

Predictive maintenance

Maintaining equipment is as important in factories as it is in office buildings. Recent advances in predictive maintenance mean that service schedules or obsolescence of machinery can be worked out ahead of time. This allows businesses to predict when maintenance needs to happen, enabling more precise forecasting and greater efficiency of process. -

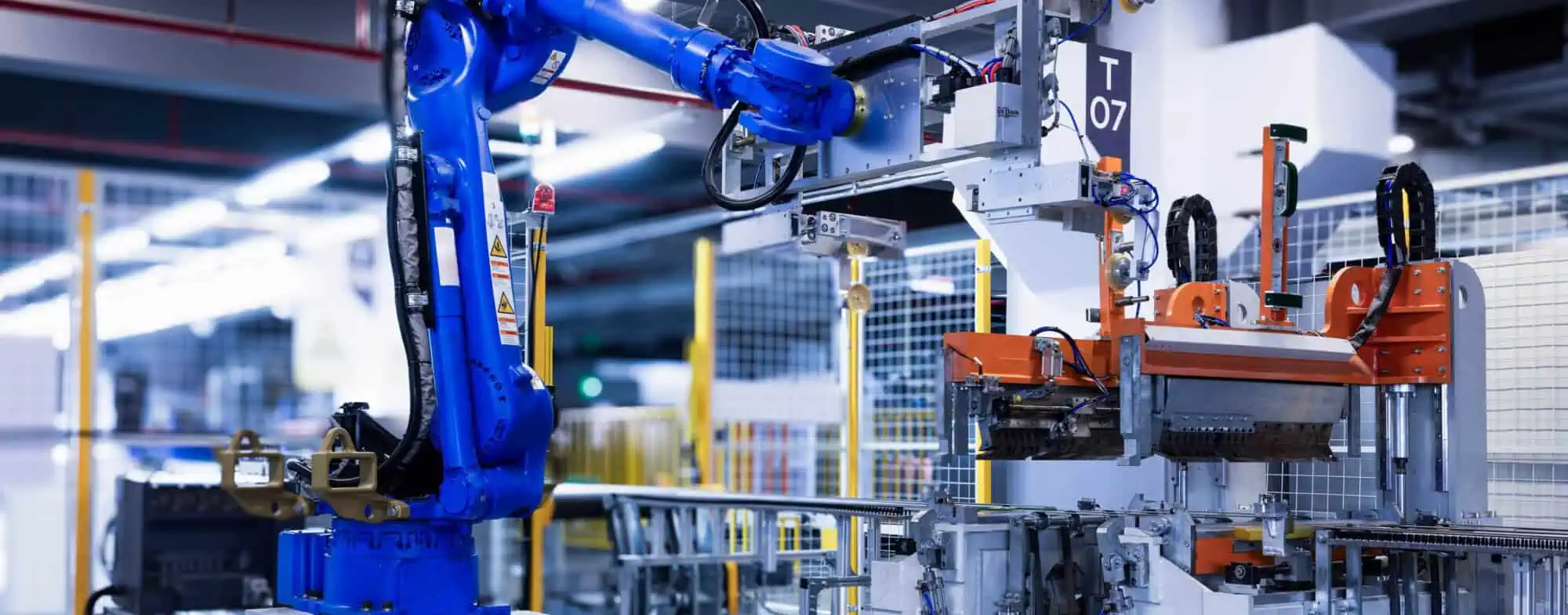

Robotics

From pharmaceuticals to warehouse logistics, robotics are making their presence felt. In advanced manufacturing, just one way that artificial intelligence (AI) is being used, is to create printed circuit boards. Machine learning is deployed to configure designs, helping with precision and reducing the risk of human error. -

Digital twin

Creating physical prototypes or pilot lines are an integral, but expensive, part of the development process. Using software to create a digital replica of something to see how it would work in real life, has huge cost and time benefits. For example, visualising how a factory or aircraft might look, or perform, when built provides important validation before progressing to prototype. As digital capabilities increase, so to do the use and sophistication of virtual test and validation methods. -

Additive manufacturing

Additive manufacturing, such as 3D printing, is increasingly used to produce complex and intricate components more efficiently and cost-effectively. This technology speeds up production by enabling greater design flexibility and the creation of advanced geometries that were previously impractical or time-consuming with traditional manufacturing methods.

Why claim R&D tax credits with ForrestBrown?

Our multi-disciplinary team is made up of chartered tax advisers, accountants and industry-experienced science and technology specialists. They bring unmatched expertise to your business to help you secure the funding you’re eligible for.

Our industry-experienced sector specialists have hands on experience of manufacturing and will work with your competent professional to review your projects and assess your R&D.

Our technical expertise is complemented by secure systems and technology to process your claim. This gives you confidence that your claims will not only be prepared rigorously, but efficiently and securely too.

Robin Taylor BEng MIED

Associate Director – Technical

Robin Taylor BEng MIED

Associate Director – Technical

- 20 years’ mechanical engineering expertise.

- Specialist in automotive body and electromechanical systems.

- Plays a key role in optimising engineering R&D claims.

Expertise & specialisms

- Mechanical and electromechanical engineering

- Automotive engineering

- Leadership

- Design

Robin is an accomplished mechanical engineer who has worked for some of the world’s most iconic companies. With two decades of industry experience, his knowledge is integral to optimising engineering claims.

After studying Automotive Engineering at the University of Leeds, Robin began his career with a Tier 1 supplier to the automotive industry. He spent five years at this manufacturer developing sealing systems for companies including Toyota, Honda and Aston Martin.

He moved to Bentley Motors and broadened his experience to whole closure systems, including bonnets, doors and tailgates. During this time Robin worked on vehicle projects such as the Mulsanne, Flying Spur, Bentayga and continental GT.

Ten years on, Robin moved to Dyson to work on their electric vehicle project, where he was the engineering manager for closures. As part of this role he managed a large team and had ownership of the body test facility. Several uniquely innovative designs were produced, including several registered for patents.

Robin not only helps our engineering clients, but also works with our wider network of automotive and mechanical engineering industry associations. As a member of the Niche Vehicle Network, Robin draws on his industry experience to support fellow members on the value of their R&D projects; speaking on webinars, joining networking events and participating in sharing insights in industry publications, such as his piece in Automotive Testing Technology International.

Robin brings this wealth of mechanical and electromechanical engineering experience to ForrestBrown. As one of our sector specialists, he helps client companies to articulate precisely where the activities which qualify for R&D tax relief occur. Robins helps to ensure that the technical part of each claim is robust.

Ben Wyatt LLB

Senior Technical Manager

Ben Wyatt LLB

Senior Technical Manager

- Expert in a huge range of developer and cloud technologies.

- Over 15 years agency experience working across many sectors.

- A dedicated resource at ForrestBrown for uncovering digital innovation.

Expertise & specialisms

- Web design and development

- Cloud technologies

- Digital awareness

- UK law

Ben is a digital expert at the forefront of tech trends. A digital sector specialist at ForrestBrown, his extensive knowledge is invaluable to our clients who are pushing the boundaries of innovation.

He began his career as a law and philosophy graduate in publishing, but quickly developed a keen interest in web development and software engineering. At the time he was working for family law publisher, Jordan Publishing, but subsequently moved from there into the world of digital agencies.

Since then, Ben has amassed more than 15 years of digital agency experience, some at general agencies; others specialising in sectors such as travel and product development. These include 3Sixty, Bray Leino, Cognizant and AKQA.

With experience as a full-stack developer and technology director, Ben has mastered a wide range of development frameworks and tools. He has worked extensively with content management systems, modern web technologies, and responsive design principles.

Ben has also developed expertise in cloud platforms and infrastructure as these technologies have emerged. In his senior roles he has led teams of developers and been involved in wider business management.

His extensive experience at agencies has led him to work across many sectors, including legal, transport infrastructure, entertainment, homebuilding and ecommerce.

Ben’s expertise is tremendously valuable to our clients at the cutting edge of digital innovation. He works directly with them and our R&D tax practice to uncover all qualifying innovations for robust R&D tax credit claims.

Katy Long CTA CA

Director

Katy Long CTA CA

Director

- Qualified chartered tax adviser and chartered accountant.

- Experienced working with portfolio of large companies.

- Expert in R&D tax policy and legislation.

Expertise & specialisms

- R&D tax policy

- Overseas R&D rules

- Merged scheme

Beginning her career with a Big Four firm and gaining experience across a range of auditing and tax roles, Katy has specialised in R&D tax relief since joining ForrestBrown in 2019.

During a time of unprecedented change, Katy has led ForrestBrown’s approach to key policy developments including restrictions on overseas R&D activities and HMRC’s introduction of an additional information form. This has included liaising with HMRC, delivering internal training and providing insights to clients.

Clients working with Katy benefit from her commercial mindset and deep knowledge of R&D tax relief, including how it can work alongside other innovation incentives. She works with a range of large and complex businesses in sectors including manufacturing, financial services and aerospace, where she is a trusted adviser on the RDEC incentive.

Katy co-authored the Tolley’s Tax Digest on R&D tax relief and has contributed articles to publications including Taxation and The CFO.

Mark Andrew

Senior Tax Specialist and Former-HMRC Inspector

Mark Andrew

Senior Tax Specialist and Former-HMRC Inspector

- More than four decades of tax experience.

- Provides strategic advice through our advisory and enquiry support services.

- Specialist in R&D tax since 2006.

Expertise & specialisms

- HMRC inspections

- UK taxation

- Training & development

Mark is a former HMRC tax inspector with more than four decades of experience. That includes time working as an inspector in HMRC’s R&D units, providing Mark with indispensable insight on the implementation of the incentive.

Joining HMRC in 1979, Mark went on to specialise in conducting enquiries into companies. He was one of the original tax inspectors assigned to the specialist R&D units in 2006, working in the Croydon unit until 2018.

He joined ForrestBrown in 2019 and his expertise is primarily shared through our enquiry support service, which provides support to clients as well as companies who have prepared claims themselves or through another adviser or partner.

The wealth of experience gained through the combination of public and private sector roles has proved invaluable so far. He helps reassure ForrestBrown’s clients, providing them with a measured viewpoint and advice on their risk profile.

Part of Mark’s drive is the challenge of debating technical issues involving the law. That includes working on Quinn’s landmark tribunal case, which tackled HMRC’s interpretation of the amount of relief available to SMEs for customer-led R&D projects.

In addition to his work in enquiry support, Mark contributes to our in-house development programme, the Learning Lab, which aims to create the next generation of tax professionals.

Find out about a typical day for Mark Andrew in our meet the expert series.

James Dudbridge LLB

Director

James Dudbridge LLB

Director

- Leads our tax advisory practice, FB Consulting.

- Solicitor specialising in corporate and personal tax.

- Track record of success at first-tier tribunal tax chamber.

Expertise & specialisms

- Complex corporate structures, including international groups

- HMRC disputes including compliance checks and appeals

- UK tax law

James leads our tax advisory practice, FB Consulting, providing award-winning R&D tax relief expertise to businesses and accountants. This can include modelling and forecasting, risk profiling and benchmarking, and advice on compliance and methodology for large corporates.

With a legal background and extensive experience dealing with HMRC, James brings incisive insights to tax disputes, developing strategies to achieve the best possible outcome for clients. For example, he successfully led ForrestBrown’s support for Quinn (London) Limited in a 2021 landmark tribunal case challenging the interpretation of subsidised R&D expenditure.

James and the FB Consulting team provide specialist advice, working alongside a company’s general advisers, including due diligence relating to R&D tax relief pre and post transactions and R&D in complex, international groups.

A solicitor who specialises in tax advice for corporates and individuals, with a focus on cross-border and international issues, James trained and qualified at a top London law firm before relocating to Geneva to help set up the firm’s Swiss office. On returning to the UK James worked in the tax team of a leading Bristol and London-based law firm, before joining ForrestBrown in 2019.

James has contributed commentary on R&D tax relief and tax disputes to publications including Bloomberg Law and International Tax Review.

Karim Budabuss CEng

Director – Grant Advisory

Karim Budabuss CEng

Director – Grant Advisory

- Grant advisory expert with Big Four experience.

- Significant experience supporting large businesses to access innovation incentives.

- Chartered engineer with the UK Engineering Council.

Expertise & specialisms

- Innovation funding

- Investment incentives and negotiated grants

- Decarbonisation projects

Karim works with large businesses, exploring all elements of the innovation toolkit, from R&D tax relief to grant funding. He takes a forward-looking approach, identifying opportunities which align with client projects and objectives.

Having previously led decarbonisation grant advisory for a Big Four firm in the UK, Karim joined ForrestBrown in 2023. His in-depth knowledge of grants provides further support for the innovative businesses we work with, enabling them to explore a wide range of funding opportunities.

Karim is a chartered engineer and gained more than five years’ experience as an engineering consultant and project manager for major infrastructure clients before specialising in innovation incentives. He has subsequently helped companies access millions of pounds from grant funding bodies such as Innovate UK, the Department of Energy Security and Net Zero, and Scottish Enterprise in sectors including aerospace, energy and manufacturing.

Through this combination of technical and finance expertise, Karim is well placed to advise businesses on their eligibility for innovation funding and the most appropriate projects for which to seek funding support, at the same time contributing to meeting some our biggest societal challenges.

At ForrestBrown, Karim has also supported multinational companies seeking to invest and create jobs in the UK, for example securing government support for the location of new manufacturing facilities.

Peter Reynolds ATT (Fellow) ICIOB

Partner – Capital Allowances

Peter Reynolds ATT (Fellow) ICIOB

Partner – Capital Allowances

- Leads ForrestBrown’s support for clients relating to capital allowances.

- Over 20 years’ experience working with businesses on asset taxation issues.

- Background in project management in the construction sector.

Expertise & specialisms

- Capital allowances and tax depreciation

- Fixed asset reporting for tax and accounting

- Cost segregation analysis for property investments

Peter specialises in capital allowances and leads ForrestBrown’s support for clients who buy, sell or incur expenditure refurbishing commercial property to optimise the tax reliefs available.

Previously a tax partner with a top 10 accountancy firm, Peter joined ForrestBrown in 2023. His in-depth knowledge of capital allowances provides further support for the innovative businesses we work with, helping to ensure they are fully rewarded for their investments.

Having started his career in the construction sector where he managed high profile projects throughout the UK and Europe, Peter combines a wealth of industry experience with technical tax knowledge to deliver pragmatic advice backed up by a deep understanding of how buildings are put together.

This mix of direct industry experience and technical tax expertise also enables Peter to structure fixed asset programmes that translate effectively for tax and accounting purposes. His approach delivers consistent, accurate information to financial teams, removing the risk of misinterpretation.

Peter draws on his experience working with FTSE100 and multinational companies across sectors including hospitality, retail, engineering and manufacturing to support ForrestBrown clients with tax reliefs relating to their investment in commercial property. Working alongside our grant advisory team, he also supports multinational businesses considering inward investment in the UK.

Grants

Whether it’s determining your eligibility or putting together a formal grant funding application, we’ve got the expertise to support your business. Our grant advisory team, led by Karim Budabuss, has extensive experience of advising clients on accessing grant funding in the UK.

Our expertise spans both negotiated and defined grants, as well as a range of grant funding bodies including government departments, Innovate UK and DASA. We can also assist with post-grant-in-principle due diligence where conflicts arise.

Capital allowances

Growth in the advanced manufacturing sector will likely mean investment in new manufacturing facilities or scaling up existing ones. If your business falls into that category, why not explore your eligibility for capital allowances relief?

It can bring significant cash flow benefits for any eligible capital expenditure, such as plant and equipment, providing valuable resources to reinvest in further growth.

Our capital allowances team, led by Peter Reynolds, has considerable experience working on asset taxation issues, as well as in the construction industry. That perfect combination of industry experience and technical authority enables ForrestBrown to deliver practical, actionable advice to support your business.

Examples of advanced manufacturing firms advised by ForrestBrown

Precision engineering company

A novel development by this engineering company saw it produce a multi-axis adaptive alignment solution for machining operations, enabling precise and automated handling of complex part geometries. Through the creation of advanced software algorithms and program logic, alongside proprietary hardware designs, the solution improved efficiency, reduced lead times, and enhanced rapid prototyping capabilities in manufacturing.

Benefit: £45k

Software and electrical engineering company

This company develops advanced software engineering and IoT solutions for building management and service optimisation. They enhance the functionality, reliability, and integration of connected devices used to monitor and control building operations through the creation of digital twin systems, performance modelling platforms and real-time alert monitoring.

Benefit: £90k

Software engineering company

This digital engineering and research organisation works across varied sectors including aerospace and automotive and use high-fidelity modelling and simulation to design, test and optimise systems before they are built. They develop digital twins, engineer high performance compute infrastructure and innovate within machine learning to support model-based systems engineering.

Benefit: £120k

Speak to us

We’re passionate about helping our clients access the valuable funding they deserve for their innovation. Speak to our team to discuss your business today.

- Telephone

- 0117 926 9022

- hello@forrestbrown.co.uk