The year 2000 was notable for many reasons. The start of the new millennium, the opening of the International Space Station and the advent of the “Millenium bug” – a computer flaw related to the formatting and storage of calendar data for dates in and after the year 2000. It also saw the launch of the groundbreaking, though now discontinued, Apple iPod and provided the hook for Pulp’s eponymous “Disco 2000”.

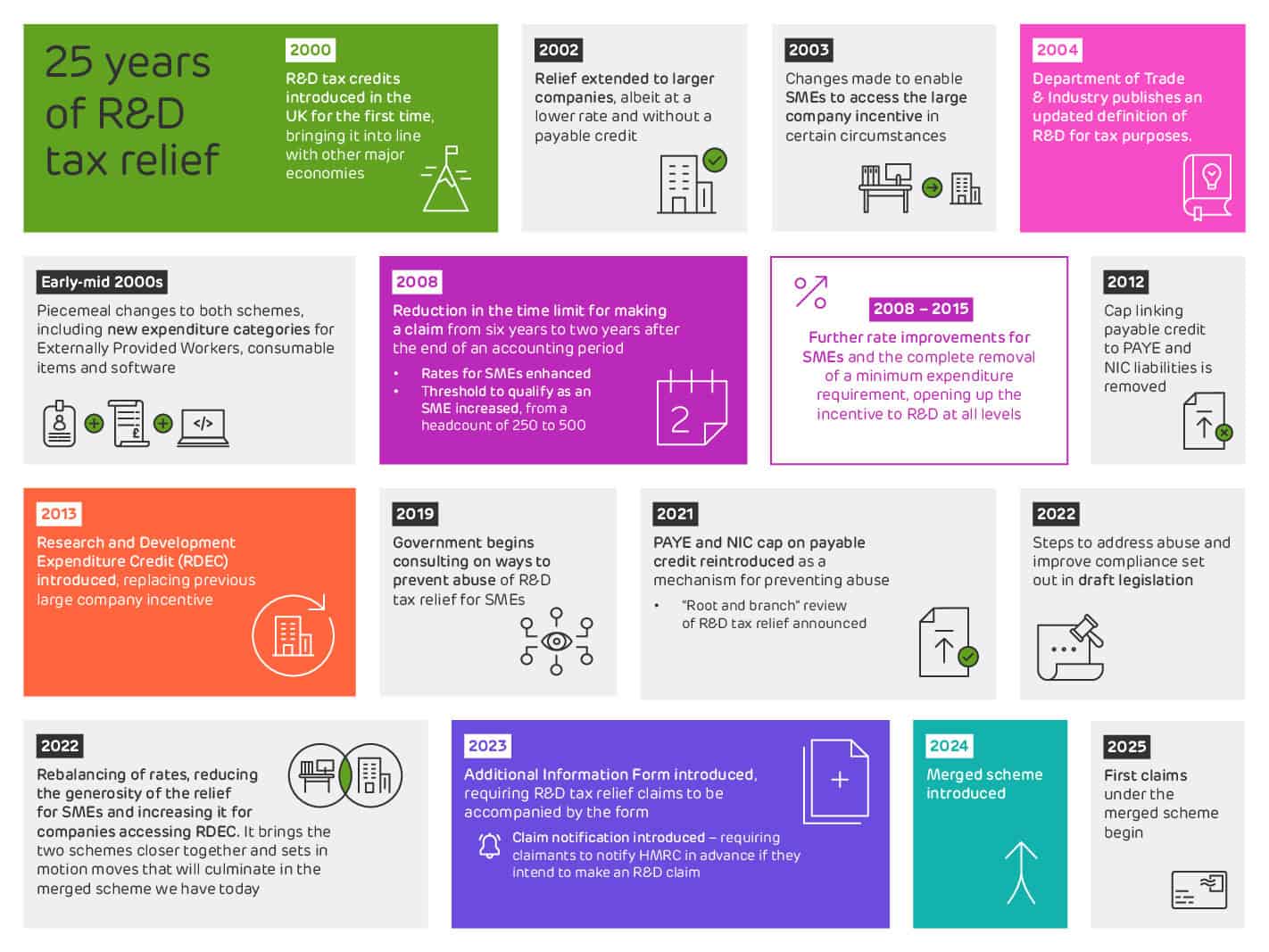

But beyond the headlines and the global stage, something else was happening too. Following a period of consultation, the first UK R&D tax incentive regime was introduced for small and medium-sized (SME) companies by the then Labour government, under Chancellor Gordon Brown. The system offered SMEs undertaking research and development (R&D) a reduction in Corporation Tax and/or a payable credit. It put the UK on a level playing field with other countries including the US and Canada, which had been offering similar tax incentives since 1981 and 1977 respectively.

It produced a mechanism whereby businesses investing in research and development could be rewarded for their endeavours, creating value not only within that business, but within the wider economy too. Research published by HM Treasury in November 2021 supported this. It found that for each £1 of tax relief claimed, as much as £2.70 additional R&D investment is generated.

Little wonder then that it has become an integral part of the innovation toolkit during the last 25 years. It’s a key mechanism for the government to help drive economic growth. But while the underlying objective remains the same, the incentive that exists today has evolved considerably since 2000. It has supported countless businesses and qualifying R&D expenditure estimated to be £46.7 billion for the tax year 2022 to 2023, despite negative recent media attention. We see in our own diverse client base the impact that claiming R&D tax relief can have on a business. From the ability to commit to a stronger R&D pipelineto attracting and retaining talent within the business, the incentive has a vital role to play in supporting the innovation ecosystem.

Statutory evolution

2000 – 2005

R&D tax relief first entered the statute books on 1 April 2000, accompanied by the publication of the first definition of R&D for tax purposes – the Guidelines. In 2004, those Guidelines were substantially rewritten, with the intention of making the definition clearer, not changing it. This updated definition has remained relatively unchanged in the years since, though its scope and ownership have evolved. Originally published by the Department of Trade and Industry, the Department for Science, Innovation and Technology (DSIT) has current responsibility for what have become known as the DSIT (formerly BEIS) Guidelines.

The minimum spend on eligible R&D in an accounting period was set at £25,000 a year and, over the next two years, SMEs began to familiarise themselves with the legislation and access the relief.

2002 marked a significant change, with the introduction of R&D tax relief for large companies. The large company relief was similar to that for SMEs, albeit at a lower rate of 7.5%, and there was no payable tax credit.

Other changes followed in 2003, including the simplification of staffing costs under the SME and large company schemes. A new expenditure category was also introduced, to allow claimants under both schemes to claim for agency workers engaged on R&D projects, known as Externally Provided Workers (EPWs). More significantly, SMEs gained the right to claim under the large company scheme, if they did not meet the eligibility criteria for the SME R&D tax credit. This allowed SMEs that were grant funded, for example, or part of a wider group, to benefit from the incentive.

2005 – 2010

The following five years saw relatively little change, with the period characterised by piecemeal changes to both schemes. These included a new definition of an SME and enhanced rates of relief for SMEs (from 50% to 75%) and large companies (from 25% to 30%). HMRC meanwhile broadened the scope of qualifying activities to include Qualifying Indirect Activities (QIAs) that support an R&D project, such as admin, finance, personnel, security and maintenance activities.

2010 – 2015

That stability continued across the two schemes, with further rate improvements for SMEs, and the removal of the minimum expenditure requirement, which opened up the incentive to businesses with different levels of expenditure.

In 2012, the cap which limited the amount of payable credit a company could claim to the total value of its PAYE and NIC liabilities, was removed. This was followed in 2013 by the introduction of Research and Development Expenditure Credits (RDEC) to replace the previous large company incentive. The move was aimed at providing greater visibility, certainty and value for loss-making companies, by allowing the benefit to be accounted for “above the line” in profit-before-tax in a company’s accounts and allowing companies with no tax liability to claim a cash credit, similar to the SME incentive.

2015 – 2020

In 2018, the RDEC rate increased to 12%, consolidating a period of stability for – and education on – the relief.

In 2019, the government launched the first in a series of consultations aimed at preventing abuse of R&D tax relief for SMEs and raising overall standards within the sector.

2020 to the present day

In more recent years, efforts to raise standards have intensified in response to negative media reporting on the incentive. In around 2020, stories began to emerge of abuse of the scheme by a minority of bad actors with illegitimate claims, seeking to exploit it. These claims ranged in value, with perhaps the highest profile being the Convergica case in 2020, which involved a fraudulent R&D claim for £29.5 million.

In October 2022, The Times ran an article highlighting abuse of the system, which was followed in December 2023 by an appearance by Jim Harra, First Permanent Secretary and Chief Executive of HMRC, at the Parliamentary Public Accounts Committee for questioning on unscrupulous R&D agents and its response.

During these years, HMRC’s compliance activity has grown significantly, resulting in a greater number of cases going into enquiry. Legislative activity has increased too. 2020 saw the publication of a further consultation on preventing abuse of the SME scheme, while an increase in the RDEC rate signalled a move towards focusing the incentive on larger companies.

In 2021, the PAYE and NIC cap on payable credit was reintroduced to the SME incentive as a mechanism for preventing abuse, while a wholesale review of the incentive got underway. The results of that review were published in 2022, when the government set out steps to address abuse and improve compliance in draft legislation.

Rates were subsequently rebalanced and the generosity of the relief for SMEs was reduced. In a show of commitment for companies accessing the incentive under RDEC, rates were increased. It brought the two schemes closer together in generosity, setting in motion moves that would culminate in the merged scheme in 2024. This followed the introduction of the Additional Information Form and claim notification in 2023, which tightened up the procedural requirements for making a claim.

A real and significant impact

R&D tax relief’s journey from fledgling incentive to flagship policy hasn’t been seamless, as the volume of policy changes over the years indicates. Rates have changed, political thinking has evolved and procedural requirements have been tightened. But R&D tax relief has weathered the storm – not just in the UK, but globally, where, according to a recent OECD report, 33 out of 38 OECD countries offered tax relief for R&D expenditures in 2023, up from 19 in 2000.

On the ground, the impact of the incentive continues to grow too. As an R&D adviser, we can cite countless examples of the benefit that it brings to businesses – large and small. It’s one of the great joys of working in this industry that we see first hand the difference the incentive makes in helping to support growth. Just as a small business may be transformed by the ability to invest in two additional staff members, so a large business may be able to invest in a new manufacturing facility to produce a groundbreaking product.

A final word

For all the positives, there are inevitable challenges, and changes that we’d welcome. Better data on business R&D investment from the Office for National Statistics, a new target for R&D as a percentage of GDP and updated research from HMRC on additionality and spillover benefits are just three. But putting more robust monitoring in place would make a significant difference and enable the industry to gain a clearer picture of the relief’s effectiveness.

A fourth is a period of long-overdue stability, following several years in which the regulatory and compliance landscape has evolved significantly. Enquiries are more common and procedural requirements such as claim notification more stringent. Rightly so. But it’s important that businesses with legitimate claims aren’t put off claiming. Instead, they must manage risk appropriately and move from a retrospective to a proactive approach to R&D – where R&D is captured in real time – to create efficiencies in process and more robust records to support claims. A stable legislative framework will support that, and in turn, help business confidence.

Just as Jarvis Cocker sang in Disco 2000 “Won’t it be strange when we’re all fully grown?”, few could have believed that R&D tax relief would have undergone such transformation in the 25 years since it came into force. While there’s scope for fine tuning, today it exists, “fully grown” and having supported countless innovative businesses to develop. Let’s hope that the next 25 will be just as impactful.

Looking for R&D support?

We’ve been there every step of the way for our clients, supporting them to access the incentive we believe in. If you’re looking for support with an R&D claim, get in touch to find out how we can support your business.