Autumn sees the annual publication of HMRC’s statistics on R&D tax credits, providing a snapshot of how businesses are benefiting from an incentive designed to encourage private sector innovation.

The latest statistics cover the financial year from 2023-24, a period which saw significant changes to R&D tax relief, including rate changes and the introduction of new administrative requirements

This is the first chance to see the impact of these changes, combined with HMRC’s continued focus on reducing error and fraud. The results make interesting reading but how you view them will very much depend on your perspective, with a divergence in the data for SMEs and large companies.

R&D expenditure has decreased

Total number of R&D claims has decreased

The average claim value has increased

Back on track or an overcorrection?

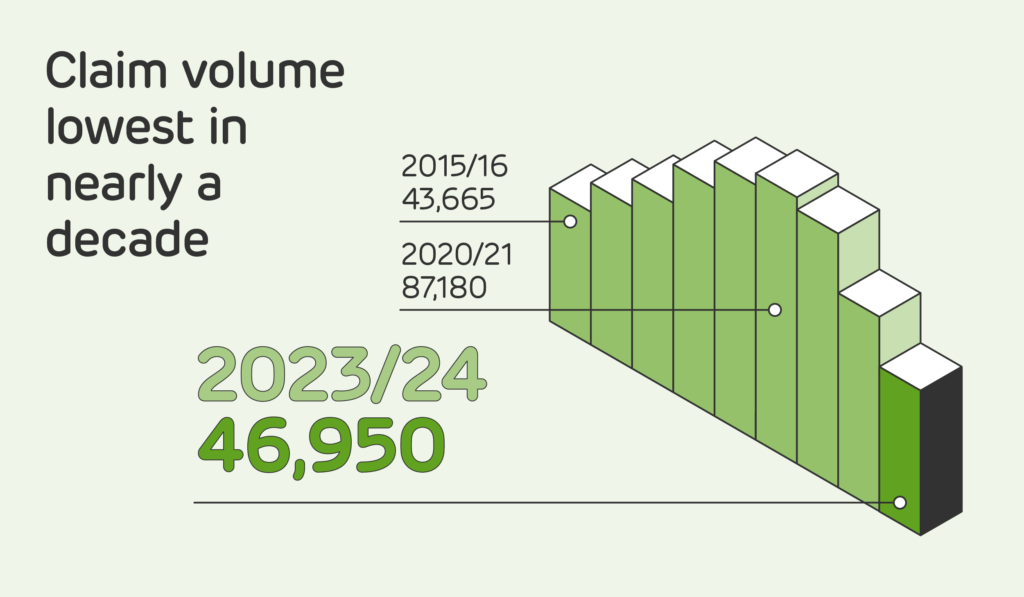

Overall, there’s been a significant reduction in the number of claims, down 26%. This is the lowest number of claims in nearly a decade, only marginally above the number seen back in 2015-16, and only just over the total from as recently as 2020-21.

The total value of relief, and the R&D expenditure on which it was claimed, were also both down compared to the previous year, albeit by smaller amounts. The average claim value increased, driven by a decrease in smaller claims and an increase at the other end of the spectrum.

For HMRC, this could be taken as a vindication of various measures to cut out error and fraud – which was more prevalent in the SME scheme. Other stakeholders may be more concerned about collateral damage, with the possibility that genuine R&D has been caught in the compliance net. Some businesses may even have been discouraged from claiming in the first place. It’s not difficult to see how this could have a knock-on impact for R&D investment, which already carries inherent risk.

Balance shift between SME and RDEC

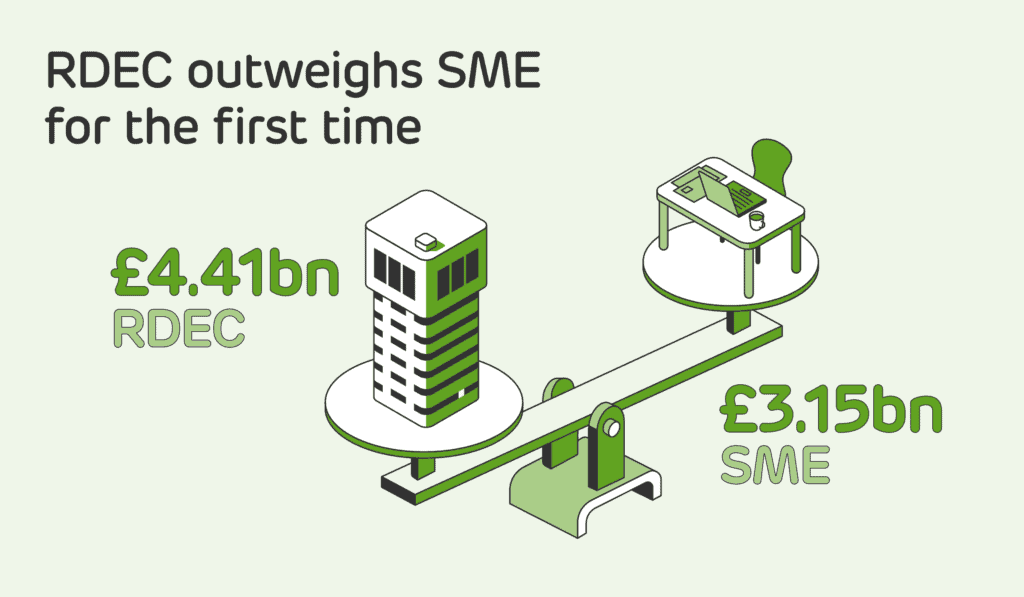

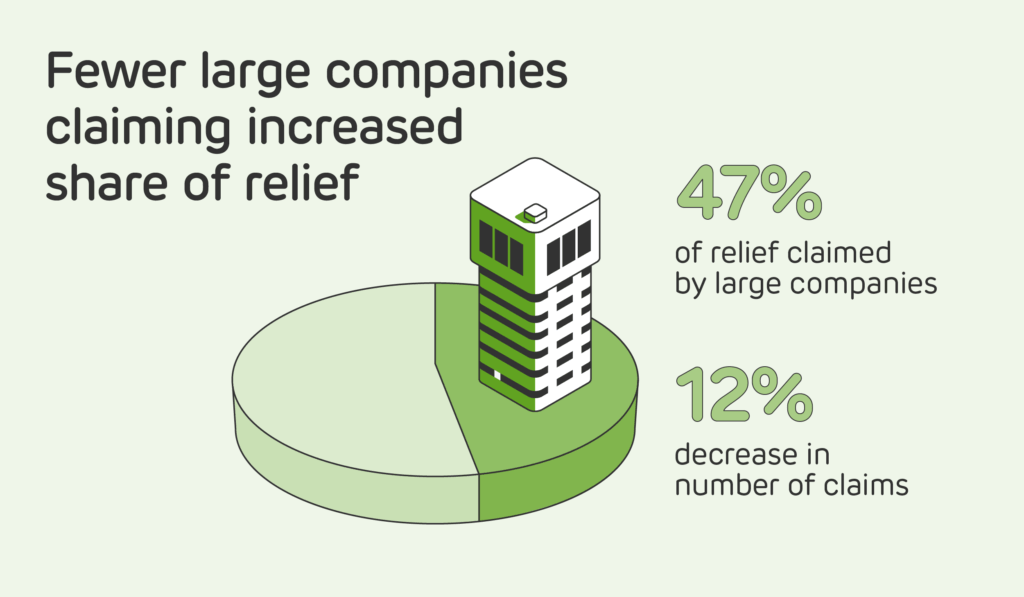

A notable difference in this year’s statistics is that relief claimed under the RDEC scheme surpassed the total for the SME scheme for the first time.

While this has, in part, been driven by an increase to the RDEC rate, some of this effect will have been offset by the increase in the main rate of Corporation Tax. The underlying dynamics suggest that negative mood music around the incentive has a disproportionate impact on SMEs, leaving larger companies to claim a bigger share of total relief. Next year’s statistics will shine a light on the merged scheme, which we expect to lock in some of these shifts.

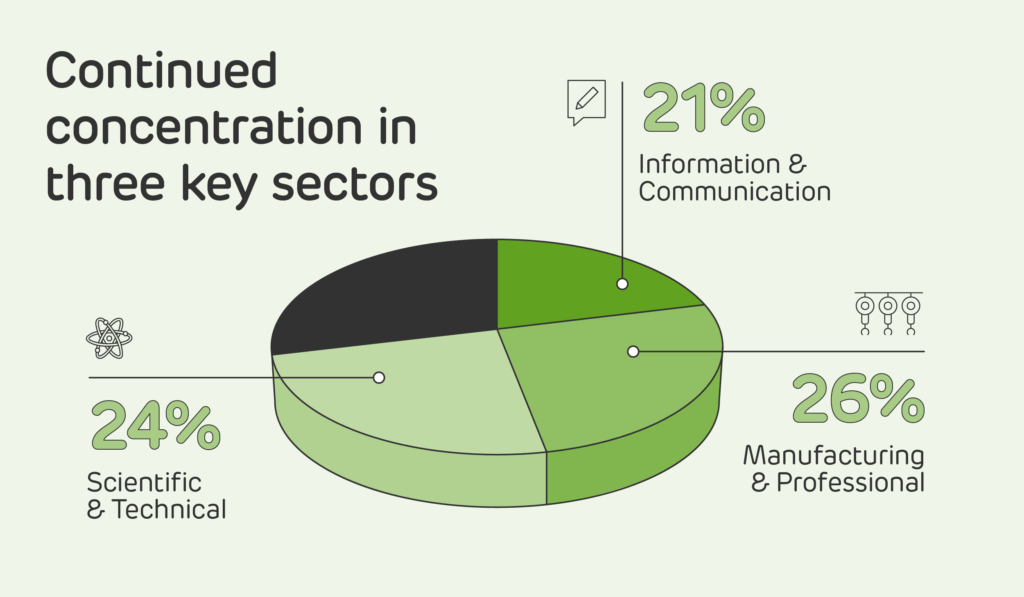

Continued concentration in three key sectors

Last year’s statistics showed that around two thirds of relief was concentrated in three key Standard Industry Classification (SIC) codes synonymous with innovation (Professional, Scientific & Technical, Information & Communication, and Manufacturing). This trend has continued, with these R&D powerhouses accounting for 71% of the total value of R&D tax relief.

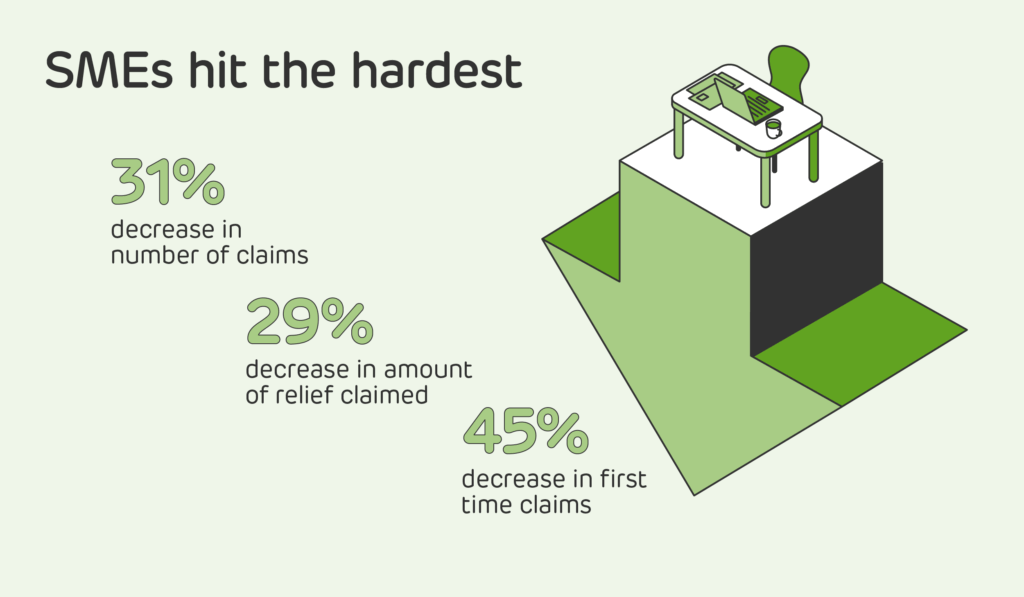

SMEs hit the hardest

SME claims have dropped by a massive 31%, with first-time claimants taking an even bigger hit, falling by 45%. These startling shifts have been driven by a combination of reduced rates and increased administrative effort, together acting as a de facto de minimis.

The statistics here are not surprising given that many SMEs may find it harder to navigate a more complex claim process. It will be interesting to see whether these changes discourage small businesses from investing in R&D or push them to seek alternative sources of non-dilutive funding.

Large companies claiming increased share

Larger businesses have benefited from the increased RDEC rate and now account for almost half (47%) of the relief claimed. This is despite the number of RDEC claims having dropped, albeit by a much smaller amount than elsewhere across the incentive. The increased RDEC rate makes large, riskier projects more viable and gives businesses greater certainty when planning investment – both positive outcomes from a mixed bag of reforms.

What’s next for innovation incentives?

We’ve been supportive of reforms to root out error and fraud in R&D tax relief and have campaigned tirelessly for improved standards in our industry. The latest data certainly suggests these reforms are starting to bite. Next year’s statistics will show us the effects of the introduction of the merged scheme and will reveal the true extent of the impact of the government’s reforms and HMRC’s compliance effort.

At a time when the UK economy would most benefit from the boost that innovation can deliver, what we really need is a period of stability to enable businesses to plan for the long-term.

ForrestBrown’s expert team can help unlock the value of your innovation.

We offer unrivalled technical expertise for businesses looking to access innovation incentives.