Key points

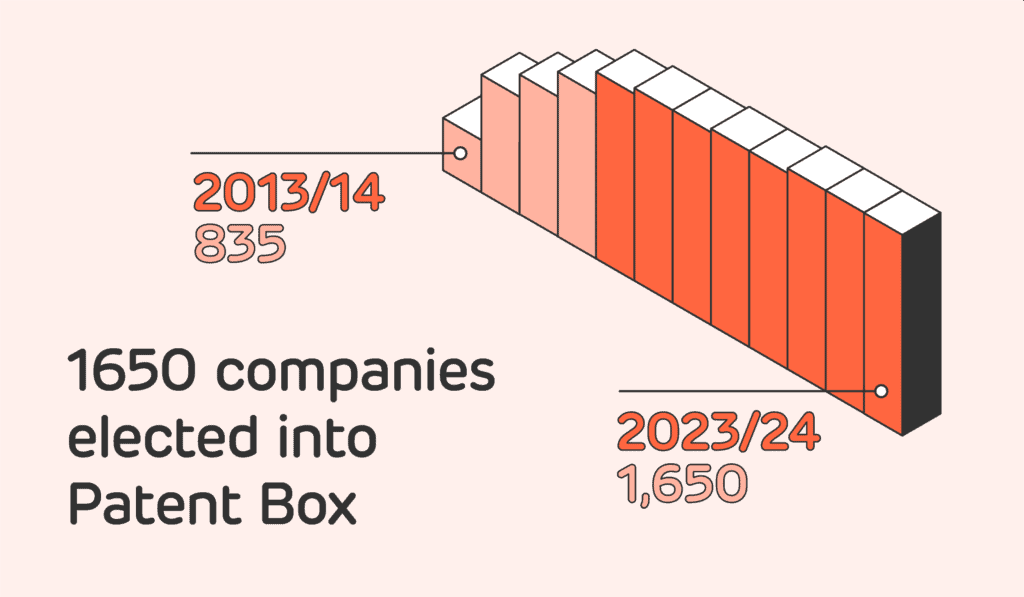

- Statistics reveal that the number of companies electing into the Patent Box regime each year remains relatively static, though the value claimed has risen.

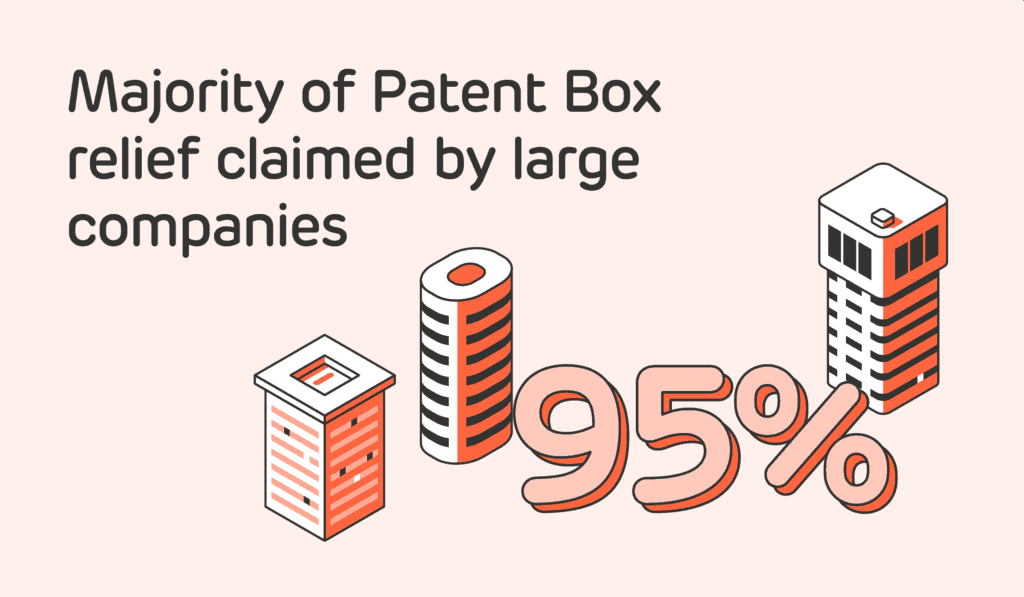

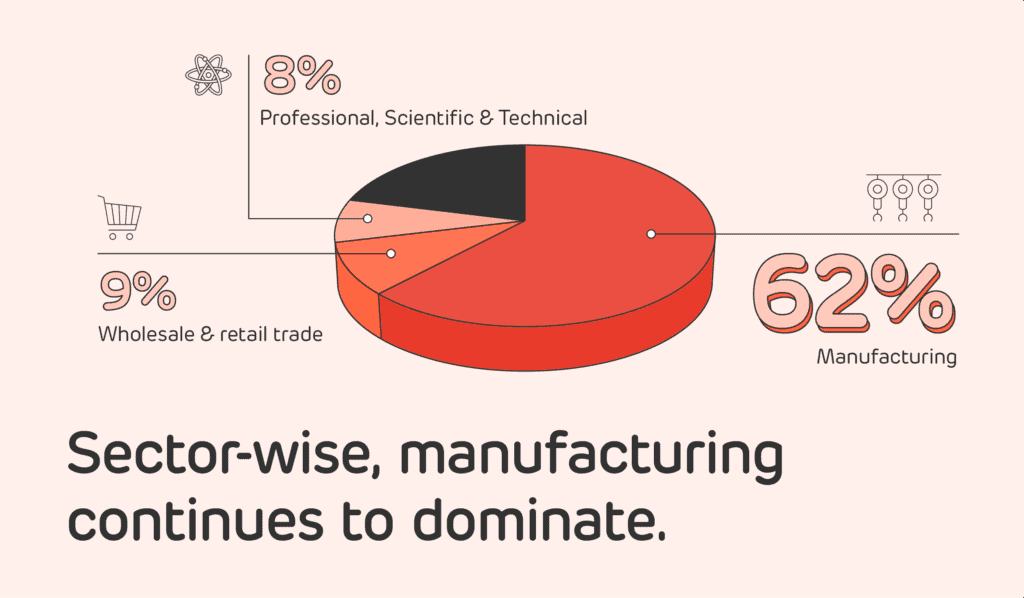

- Large companies – particularly in the manufacturing sector – continue to be the primary recipients of the relief.

- Figures suggest that businesses continue to miss out on valuable Corporation Tax reductions, despite potentially being eligible.

The government has today released its Patent Box statistics for the tax year 2023/24.

The provisional figures reveal that the number of companies electing into the regime has changed little since 2022/23, with just ten more businesses making use of this valuable incentive.

For the 1,650 companies electing in in 2023/24 though, there was a significant increase in the value of the relief, which rose by over £500 million from £1,449 million in 2023/23 to £1,977 million in 2023/24.

At first blush, this appears positive, with companies receiving a greater reward for their innovation. But delve a little deeper and the statistics indicate that the uplift was driven by a change in the main rate of Corporation Tax from 19% to 25% on 1 April 2023. In fact, the value of Patent Box relief has been broadly flat since 2017/18.

Business type: In terms of business type, large companies continue to be the primary recipients of the relief, with 95% of the total relief claimed going to them – a slight increase from 93% in 2022/23. This indicates that SMEs continue to miss out on valuable Corporation Tax reductions, despite being eligible.

Sectors: Sector-wise, manufacturing continues to dominate. Companies based in this sector accounted for 62% of claims, representing 41% of value. The remainder were from a range of sectors, including professional, scientific and technical (8%) and wholesale and retail trade (9%).

Regions: The regional analysis provided comes with the usual caveat that the prevalence of headquarters in London skews the distribution somewhat, and may not reflect where innovation is taking place. However, as a proud Scot, I’d like to see more than 65 Scottish companies benefiting from Patent Box relief. ForrestBrown’s Scotland office sees some great examples of IP development in the work we do supporting clients with R&D tax relief, so we know the potential benefit could be much higher.

It’s also worth noting that 10% of companies electing into Patent Box in this period received no relief in the same year – a reminder that companies need to elect in on an annual basis to maintain their right to claim. The figure may also include some companies who have elected in while patents are pending, protecting yearly claims until the year of grant.

Ongoing misconceptions and lack of awareness

The statistics, while offering an interesting insight, don’t deliver any surprises. Our experience suggests that despite the thousands of patents granted annually, awareness of Patent Box relief remains low, inhibiting claims. Inevitably, not every company with a patent will meet the eligibility criteria for Patent Box relief, but many will. It’s disappointing that owing to an ongoing lack of awareness, many businesses don’t claim.

We also find that ongoing misconceptions about how the relief operates deter eligible claimants. This is typically a problem in areas such as software, where there is often strong eligibility, but preconceptions holding businesses back from claiming.

For example, businesses often think they must wait for a patent to be granted before claiming, when in fact claims can be made beforehand and backdated for up to six years. They might also be unaware that claims can made annually, or that relief can apply to worldwide income routed through UK accounts.

Whatever the reason, Patent Box remains a key tool in the innovation toolkit. With greater awareness and education, we could elevate its position and see this underutilised incentive grow to reward all eligible businesses for their investment in R&D and innovation.

What is patent box relief?

Patent Box relief rewards your intellectual property (IP) investment by helping to reduce your Corporation Tax rate on qualifying IP income to 10%.

Certain eligibility criteria apply in order to claim the relief. This includes:

- Being liable to UK corporation tax.

- Making profits from the exploitation of patented inventions.

- Owning or having an exclusive licence over patents.

- Undertaking qualifying development of the patent.

- Where part of a group company meets the active ownership condition.

Find out the answers to all of your patent box questions on our explained page or discover how ForrestBrown can support you Patent Box Relief claim.

Ready to claim Patent Box relief?

If you think your business meets the criteria for Patent Box eligibility, why not get in touch with our team of experts, who can guide you through the claim process?