SMEs looking to claim R&D tax relief for accounting periods beginning on or after 1 April 2024, will fall into one of two schemes:

- the R&D merged scheme for non-intensive SMEs (an SME with less than 30% of total expenditure on qualifying R&D).

- the enhanced rate for R&D intensive loss-making SMEs (ERIS) – an R&D intensive SME with more than 30% of total expenditure on qualifying R&D.

You can find out more about the schemes available to eligible SMEs by clicking on the above links.

To summarise, if you spend 30% or more of your overall expenditure on R&D, and are considered loss-making for tax purposes, then this qualifies your business for an enhanced rate of R&D tax relief – ERIS. If you spend less than 30% of your total expenditure on qualifying R&D then you will need to access the merged scheme.

Grants and subsidies no longer impact R&D claims under either of these new schemes. It’s important to understand the new rules on contracted out R&D though as they require careful consideration where there is more than one party involved in the R&D.

For accounting periods prior to 1 April 2024, small to medium sized enterprises can access the SME R&D tax credit scheme or RDEC scheme, depending on specific scenarios. You can find out more about the definition of SME, rates and other details by clicking below:

CLICK FOR INFORMATION ON SME CLAIM PERIODS BEFORE 1 APRIL 2024

What is the definition of an SME for R&D tax purposes?

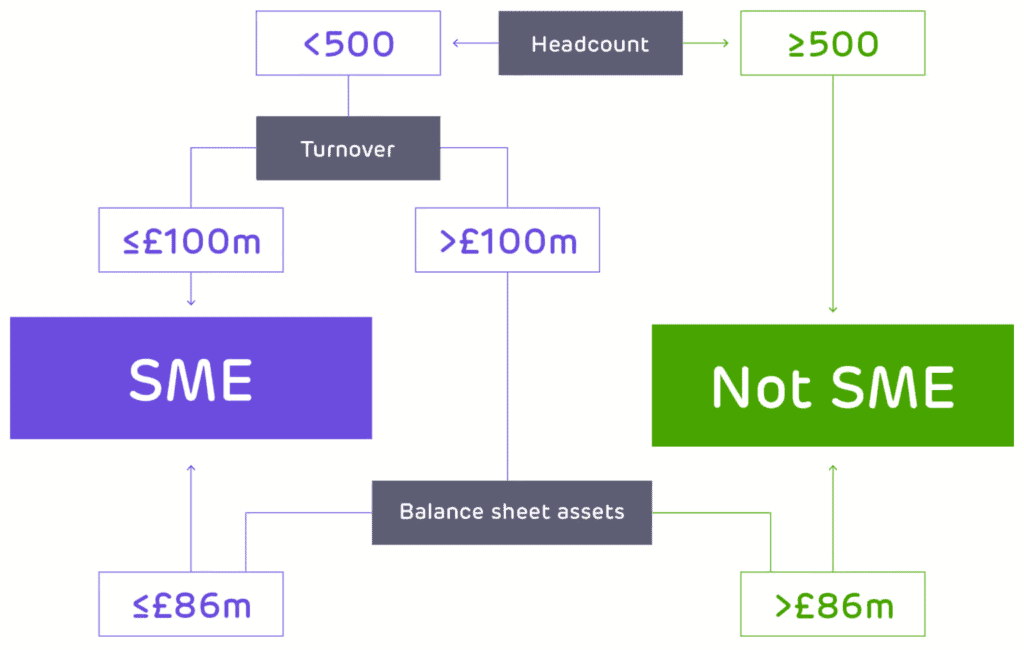

To claim ERIS or R&D tax credits under the SME incentive for periods prior to 1 April, you must have fewer than 500 staff, and either:

- A turnover of no more than €100 million; or

- Gross assets of no more than €86 million.

If your staff headcount is lower than 500, but you exceed both the turnover and gross asset thresholds, you will be classed as a large company for R&D tax credit purposes and need to use the Merged Scheme for accounting periods starting on or after 1 April 2024 or the RDEC scheme for accounting periods commencing prior to 1 April 2024.

Impact of new incentives for SMEs

Although there has been a reduction in the generosity of the rates for SMEs under the new scheme, if you’re an innovative SME, you shouldn’t be deterred from claiming. The R&D tax relief landscape has evolved significantly in recent years, but with the right advice, claiming the incentive remains beneficial.

ForrestBrown can advise you on which SME scheme you should use, as well as supporting you throughout the claim process. We can also help evaluate your eligibility for other innovation incentives such as Patent Box relief, grants and capital allowances, ensuring that you get maximum benefit for your innovation.

Explore R&D tax relief with ForrestBrown

ForrestBrown’s tax experts have significant experience of advising SMEs on claiming R&D tax relief. Whether you’re new to claiming or have claimed previously under the old scheme, we can support you with a full project review and identifying the route that best suits your needs.

SME R&D tax credit claims for accounting periods commencing before 1 April 2024

In this section, we will focus on claim periods commencing before April 2024, covering the definition of an SME and whether you claim using the SME R&D scheme or RDEC.

Find out more from HMRC on Research & Development Tax Relief for Small and Medium Sized Enterprises.

If you meet the definition of an SME for R&D tax purposes as outlined above, then you can claim R&D tax credits under the SME scheme. The rate of relief still depends on your R&D intensity.

SME R&D rates

R&D tax relief is worth up to 27p for every pound spent on qualifying expenditure between 1 April 2023 and 31 March 2024. This effective benefit of 27% applies to R&D intensive SMEs whose qualifying R&D expenditure constitutes at least 40% of their total expenditure.

If your qualifying expenditure falls below 40% of your total expenditure, then the rate for loss making SMEs is up to 18.6% and up to 21.5% for profit-making SMEs.

SME status and RDEC – for accounting periods ending before 1 April 2024

For accounting periods starting prior to 1 April 2024, the RDEC incentive is claimed by large companies and some SMEs who cannot access the SME incentive for contracted out or subsidised R&D. RDEC can be a useful tax incentive for some SMEs.

As an SME, you should be interested in RDEC (rather than R&D tax credits) if:

- You have received a grant or subsidy in respect of an R&D project.

- You have carried out subcontracted R&D on behalf of someone else.

RDEC is worth 15p for every pound spent on qualifying expenditure, with a rate of 20% for expenditure between 1 April 2023 and 31 March 2024.

We will look at each of these scenarios in the context of the pre-1 April 2024 rules in more detail:

Grants and subsidies and RDEC

There is a common misconception that if an SME receives a grant it cannot claim R&D tax credits at all. RDEC is still available on any expenditure excluded from the SME R&D tax incentive.

Accepting a grant may restrict your use of the SME R&D tax credit scheme, but it does not exclude you from RDEC. How the grant is structured and defined will have a large bearing on what relief is available to the SME recipient under each scheme.

Subcontracted R&D and RDEC

As an SME, if you carry out R&D which has been subcontracted to you, you won’t be able to make a claim via the SME R&D tax credit scheme. If you are carrying out the R&D for another SME company, they will claim for these activities. However, if you’re working for a large company, you can claim via RDEC for this expenditure.

Before you decide which route to take you first need to understand the nature of your subcontracting relationship and, in particular, who owns the R&D. Our Knowledge Bank article on subcontracting explores this issue in further detail.

What is the difference between RDEC and the SME R&D tax credit prior to 1 April 2024?

What qualifies as R&D is the same for both schemes. But they differ in terms of their eligibility criteria, the R&D tax credit rate, what qualifying costs can be included, and how the benefit is calculated.

Differences in eligibility criteria

There are fewer eligibility criteria for RDEC than there are for the SME R&D tax credit incentive. Most notably, if you’re using RDEC, it doesn’t matter if your R&D is grant-funded. In addition, unlike the SME relief, you can usually claim for R&D activities contracted out to you.

Differences in R&D tax credit rate

The rate of relief for RDEC is less generous than the SME R&D tax credit – 10.53% compared to 33% (pre April 2023) or 15% compared to 21.5% (post April 2023). That said, claims made by large companies often involve much larger qualifying expenditure meaning the value of the benefit they receive is also higher.

Differences in qualifying costs

The expenditure types that you can include for subcontracted R&D differ between RDEC and the SME R&D tax credit. If you are making an RDEC claim, money spent on subcontractors does not normally qualify for relief – unless the subcontractor is an individual, a partnership of individuals or a charity, higher education institute, scientific research organisation or health service body. If you are making an SME claim, you can include 65% of payments made to unconnected parties.

Contributions made towards funding relevant independent R&D only count as qualifying expenditure under the RDEC scheme.

Ready to start your SME claim?

Whatever accounting period you’re looking to claim for as an SME, ForrestBrown will offer tailored support to ensure you receive the benefit your innovation deserves. We provide the right technical approach and practical advice to put your business in the best possible position to meet your next innovation challenge.

- Telephone

- 0117 926 9022